Advertisement

Advertisement

S&P 500 Nears Record High on Stimulus Hopes, Strong Eernings

By:

(Reuters) - The S&P 500 index neared a record high on Monday as a $1 trillion infrastructure bill and strong second-quarter corporate earnings lifted sentiment ahead of a deluge of macroeconomic data this week.

By Sagarika Jaisinghani

All 11 S&P indexes were trading higher, with consumer discretionary and financial stocks leading gains.

Shares of Square Inc, the payments firm of Twitter Inc co-founder Jack Dorsey, rose 3.6% after it said it would purchase Australian buy now, pay later pioneer Afterpay Ltd for $29 billion.

Afterpay’s Australia-listed stock surged 18.8%.

Trillions of dollars in stimulus have lifted Wall Street to record highs following the coronavirus-driven crash last year, while upbeat second-quarter corporate earnings led the S&P 500 to its sixth monthly gain in a row in July despite the growing threat from the Delta variant of the coronavirus.

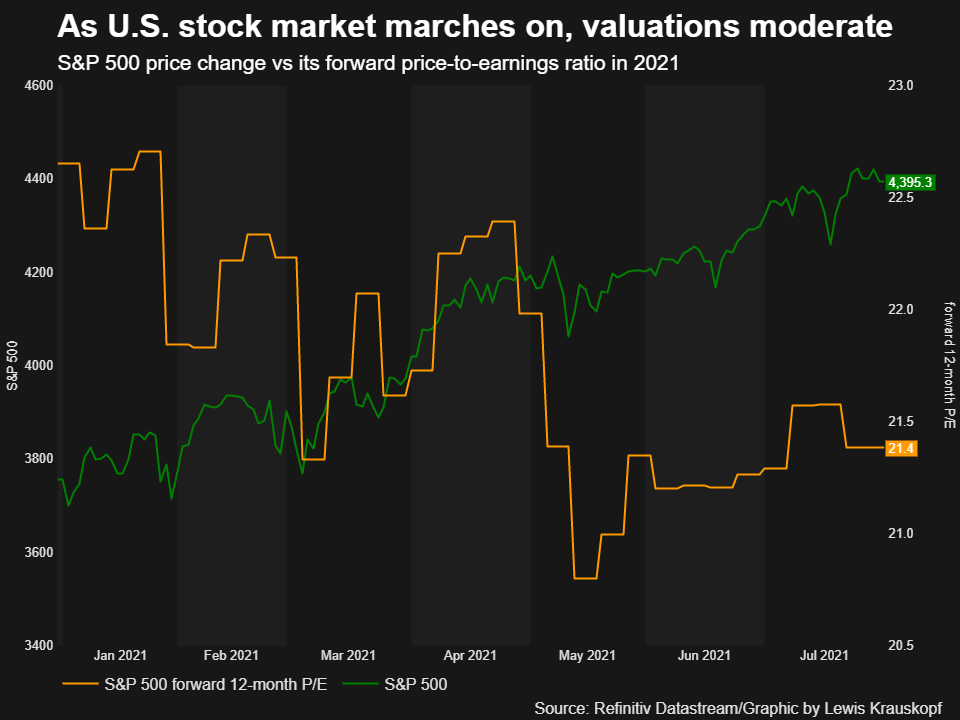

The rebound in corporate profits and a recent drop in bond yields have also helped to moderate U.S. equity valuations, bolstering the case further for owning stocks.

“The second-quarter earnings season has been nothing short of spectacular,” said Art Hogan, chief market strategist at National Securities in New York.

“We would recommend a diversified equity allocation with a barbell approach that has growth exposure on one end and economically sensitive cyclical exposure on the other.”

The S&P value index, which houses economy-linked stocks including industrials, energy and financials, rose 0.5% last week, far outperforming a 1.1% drop in the S&P growth index.

At 9:33 a.m. ET, the Dow Jones Industrial Average was up 0.45%.

The S&P 500 was up 0.53% and the Nasdaq Composite was up 0.48%, both boosted by heavyweight technology stocks.

Shares of infrastructure-related stocks including Caterpillar Inc inched higher as the Senate on Sunday unveiled the $1 trillion bipartisan plan to invest in roads, high-speed internet and other infrastructure.

Focus now turns to business activity data and the Labor Department’s monthly jobs report this week against the backdrop of fears the fast-spreading Delta variant could hit growth in the second half of the year.

“I don’t think investors are worried about broader macroeconomic numbers even if they are showing signs of a slowdown; the concern lies in the risk of reopening being on pause because of the spread of the Delta variant,” said Dennis Dick, a proprietary trader at Bright Trading LLC.

After mixed quarterly reports from technology behemoths last week, all eyes this week are on earnings from companies including Eli Lilly and Co, CVS Health Corp and General Motors Co.

Shares of ride hailing firms Uber Technologies Inc and Lyft Inc rose about 1% ahead of their second-quarter results this week, where investors will look for comments on how an ongoing driver shortage and the Delta variant were clouding the outlook for the year.

Advancing issues outnumbered decliners 3.11-to-1 on the NYSE and 2.68-to-1 on the Nasdaq.

The S&P index recorded 49 new 52-week highs and two new lows, while the Nasdaq recorded 43 new highs and 10 new lows.

(Reporting by Sagarika Jaisinghani and Shashank Nayar in Bengaluru; Editing by Shounak Dasgupta)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Advertisement