Advertisement

Advertisement

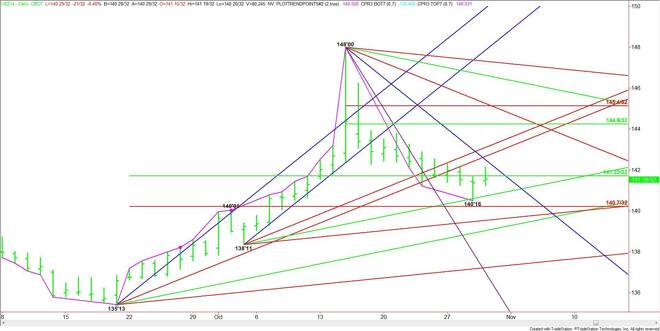

30-Yr U.S. Treasury Bonds (US) Futures Technical Analysis – October 31, 2014 Forecast

By:

December 30-Year U.S. Treasury Bonds are holding steady after the Bank of Japan announced additional stimulus. Traders are trying to figure out whether

December 30-Year U.S. Treasury Bonds are holding steady after the Bank of Japan announced additional stimulus. Traders are trying to figure out whether the move will drive up demand for T-Bonds because of a more favorable interest rate differential, or force interest rates lower because the move by the BOJ may be indicating a slowing global economy.

The main range is 135’13 to 148’00. After testing its retracement zone at 141’23 to 140’07, the market appears to be developing an upside bias. This will be determined by investor reaction to the 50% level at 141’23.

Sustaining a move over 141’23 could generate enough upside momentum to reach the steep downtrending angle at 142’16. Don’t expect an acceleration to the upside, however, unless buyers are able to generate a breakout over the pair of uptrending angles at 142’21 and 143’03.

A failure at 141’23 will mean that there aren’t any buyers in the market. This could trigger a break into the next uptrending angle at 140’23. A failure here will mean a test of the Fib level at 140’07 is next.

Watch the price action and order flow at 141’23.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement