Advertisement

Advertisement

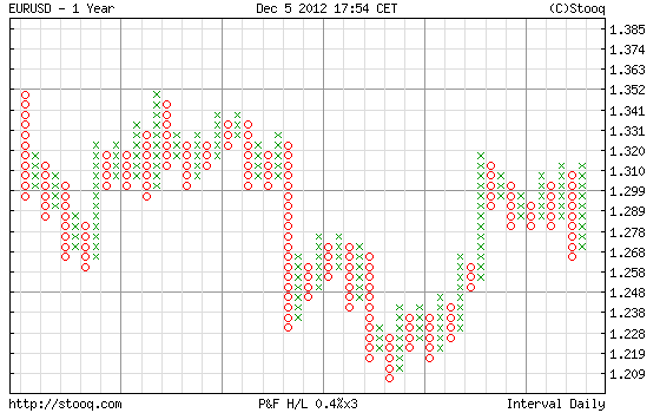

6th December 2012 EUR/USD Review: Downtrend in the Short Term is Likely to Persist

Updated: Aug 21, 2015, 00:00 GMT+00:00

If the Europe and US traders remembered a thing yesterday, that is they had shorted the EUR/USD. Despite months of bullish run for the Euro dollar, there

If the Europe and US traders remembered a thing yesterday, that is they had shorted the EUR/USD. Despite months of bullish run for the Euro dollar, there were real signs of the uptrend dying. These were none other than the major resistance at 1.3120 and poor fundamentals from the Euro Zone, it is no doubt they are ringing the bell of traders. A probable fall is targeted in the 1.278 region as seen in the chart above where recent prices have buoyant off.

The whole Europe and USA sessions (in light blue rectangles) are filled with the reigning sellers. The next 2 dark blue boxes (Sydney and Tokyo Sessions) also reflected the negative sentiment of the Euro Dollar. I remembered the days when positive initial jobless claims were released, Asian session will always acknowledge it by their bullish buys. Apparently, they seem to be expecting negative surprise and this is no doubt with the disappointment from ADP nonfarm employment last afternoon.

The signs from all 3 sessions are pointing this pair down, buying at an up move may be a prudent choice to do in todays session.

About the Author

FX Empire editorial team consists of professional analysts with a combined experience of over 45 years in the financial markets, spanning various fields including the equity, forex, commodities, futures and cryptocurrencies markets.

Advertisement