Advertisement

Advertisement

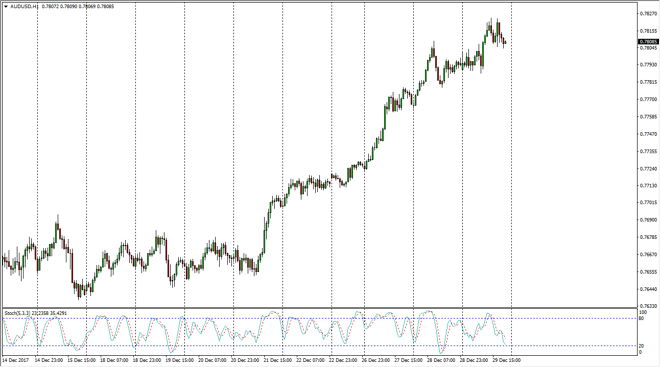

AUD/USD Price Forecast January 2, 2018, Technical Analysis

Updated: Dec 30, 2017, 07:13 GMT+00:00

The Australian dollar rallied a bit during the trading session on Friday, as the US dollar continues to get pummeled. Ultimately, the market will find gold rallying to be a boost for the Australian dollar, and I think we will find plenty of bullish pressure.

The Australian dollar rallied a bit during the session on Friday, reaching towards the 0.7825 handle, but did pull back a little bit later in the day. The Australian dollar is highly influenced by the gold markets, which have broken out and that of course is a very bullish sign. We have a nice uptrend in the market on the hourly chart anyway, so I think it’s only a matter of time before the buyers get involved on these dips. We are reaching the oversold area on the hourly chart, so I think a cross is coming, and when that cross happens it should be a nice buying opportunity. I believe that eventually we go to the 0.0 level above, which is the major fulcrum for price over the last several decades.

I have no interest in shorting this market until we break down below the 0.77 handle, something that doesn’t look very likely to happen in the short term. A breakdown below there, the market then goes looking towards the 0.75 handle. Ultimately, this is a market that continues to offer opportunities for those who are willing to take advantage of dips. The US dollar has been getting pummeled against most currencies around the world, the Aussie of course isn’t going to be any different. With gold rallying based on that move, it makes sense that it moves money into this market as well. Once we get volume back in the marketplace, I think that the Aussie will rally rather significantly.

AUD/USD Video 02.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement