Advertisement

Advertisement

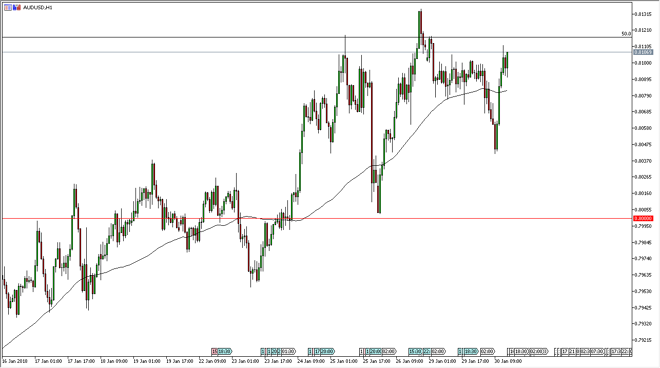

AUD/USD Price Forecast January 31, 2018, Technical Analysis

Updated: Jan 31, 2018, 04:43 GMT+00:00

The Australian dollar has rallied again during the day on Tuesday, reaching towards the 0.81 level again. However, we continue to see a lot of noise in this market, as we are approaching a major breakout level, which could lead to a “buy-and-hold” situation.

The Australian dollar initially fell during the day on Tuesday, reaching down towards the 0.8050 level, but found enough support there to bounce significantly and reached towards the 0.81 handle. If we can break above the 0.8135 level, it would be a fresh, new high, and should send this market much higher. I believe that point, the market would be ready to go towards the 0.85 level, as it is a level that should attract a lot of psychological importance. Keep in mind that the gold markets have a major influence on where the Australian dollar goes, but right now we are dancing around an area that goes back to the late 1980s for importance.

I believe that the market should continue to be positive overall, so I look at pullbacks as opportunities to pick up a bit of value. The 0.80 level is massive support, and I think there would be a lot of buying in that general vicinity. However, if we can finally break out to the upside I think this could be one of the better trades for the year. The gold markets breaking above the $1400 level could make this move explosive, so keep that in mind as well, and the US dollar course has been beaten up against most Forex markets. I think that continues to be the same situation going forward for the rest of the year, and therefore it is only a matter of time before a long position is profitable. If we broke down below the 0.80 level, then I think we would reset and look for support at lower levels.

AUD/USD Video 31.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement