Advertisement

Advertisement

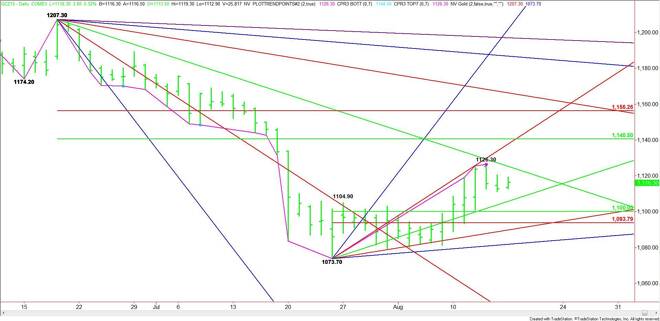

Comex Gold Futures (GC) Technical Analysis – August 17, 2015 Forecast

By:

December Comex Gold futures are trading slightly better shortly before the cash market opening. Compared to last week’s price action, today’s trading

December Comex Gold futures are trading slightly better shortly before the cash market opening. Compared to last week’s price action, today’s trading activity is relatively calm.

Last week, the market rallied to $1126.30 before enough sellers came in on August 13 to form a potentially bearish closing price reversal top. The main trend is down on the daily chart. Despite several days of counter-trend momentum, the reversal suggests the presence of sellers.

The first downside target to day is an uptrending angle at $1105.70. The primary downside target is a retracement zone at $1100.00 to $1093.80. This is followed by another uptrending angle at $1089.70.

The next key area to watch is $1100.00 to $1093.80. If the trend is getting ready to turn up then this zone must hold as support in order to form a secondary higher bottom.

The first upside objective today is a long-term downtrending angle at $1125.30. Overcoming this angle will signal the presence of buyers. Taking out the reversal top at $1126.30 will negate the reversal top. This could trigger an acceleration into an uptrending angle at $1137.70.

Overcoming $1137.70 will put gold in a bullish position. The primary upside objective is a wide retracement zone at $1140.50 to $1156.30.

With gold trading inside a triangle formed by angles at $1125.30 and $1105.70, we could be looking at several days of sideways trading. A sustained move over $1125.30 will set a bullish tone, however. And a sustained move under $1105.70 will give the market a downside bias.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement