Advertisement

Advertisement

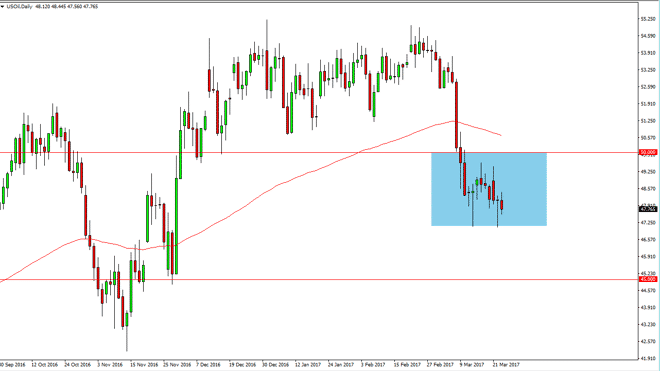

Crude Oil Forecast March 24, 2017, Technical Analysis

Updated: Mar 24, 2017, 04:37 GMT+00:00

WTI Crude Oil The WTI Crude Oil market initially tried to rally during the day on Thursday, but found enough bearish pressure to continue going lower as

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Thursday, but found enough bearish pressure to continue going lower as we consolidate overall. I believe that the market is going to reach towards the $47 level below, which had been so supportive during the day on Thursday. Because of this, I’m a seller short-term rallies and believe that the markets will continue to offer selling opportunities. A breakdown below the $47 level should send this market down to the $45 handle, which has been very important in the past. It’s a large, round, psychologically significant number so I do believe that there will be a certain amount of interest in that area. Rallies that show signs of exhaustion should be nice selling opportunities, I have no interest in buying but I do recognize that there could be quite a bit of back-and-forth trading in the short term.

Crude Oil Forecast Video 23.3.17

Brent

The brand market found itself testing the $50 handle, and if we can break down below the hammer from the Wednesday session, I believe that the market should continue to go much lower. I think rally should be selling opportunities, and that the absolute ceiling of the market should be closer to the $53 handle. Given enough time, I believe the Brent breaks down significantly, reaching towards the $47 level. Brent markets course will have to deal with oversupply, which is getting to be far too strong for the buyers.

I think rallies that show signs of exhaustion will be a nice selling opportunities going forward. I think that traders will continue to punish this market repeatedly, as the overall picture for oil markets looks very soft and as if it continues to deteriorate longer term. I believe that the longer-term trend will remain very bearish, and therefore I am ignoring all opportunities to the upside as the breakdown in this market continues to be rather strong. In fact, I currently have no scenario in which I believe putting money to work to the upside is viable.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement