Advertisement

Advertisement

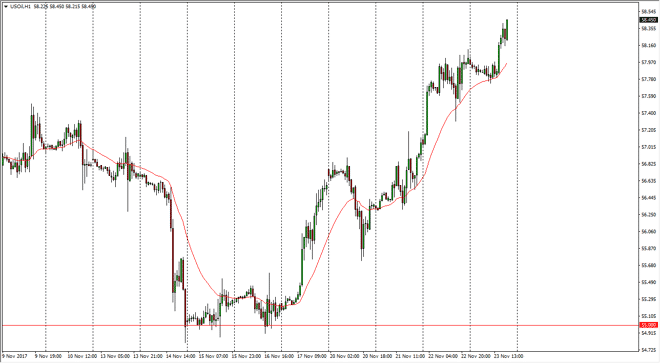

Crude Oil Price Forecast November 24, 2017, Technical Analysis

Updated: Nov 24, 2017, 05:05 GMT+00:00

WTI Crude Oil WTI markets have rallied during the day on Thursday and what would have certainly been very thin trading. By breaking above the $58 level,

WTI Crude Oil

WTI markets have rallied during the day on Thursday and what would have certainly been very thin trading. By breaking above the $58 level, it looks as if we are going to go to the next significant level, the $60 handle. Buying on pullbacks on short-term charts will probably continue to pay dividends, and I think that the $60 level will be a much more stringent fight. Over the next couple of sessions, this could be a bullish market, but at $60 I would expect a certain amount of profit-taking, if not outright selling as American drillers will jump online. I don’t have any interest in shorting quite yet, I think that $60 will almost certainly have to be tested. It will be volatile, but I believe that the upward bias will reassert itself on pullbacks if we can stay above the $57.50 level.

Crude Oil Forecast Video 24.11.17

Brent

Brent markets rallied as well, after initially falling. Most of the move in the WTI market was probably due to an oil spill on the Keystone pipeline, which of course the Brent market doesn’t have the bullish pressure from that issue. However, it looks as if we are going to try to go towards the $64 level above, which has been resistance in the past. I think that the market will continue to find buyers on dips, and if we can break above the $64 level, the market is very likely to go looking to the $65 level after that. In general, the market should continue to be noisy, and I would expect a pullback rather soon, perhaps near the $64 level, if not the $65 level. If we do pull back from here, it’s likely that the $62 level underneath will be the target.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement