Advertisement

Advertisement

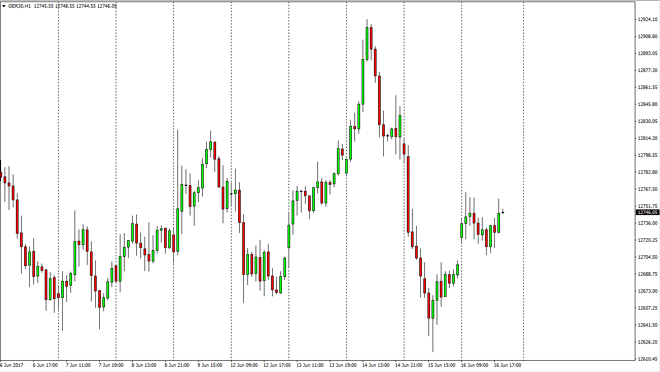

DAX Index Price Forecast June 19, 2017, Technical Analysis

Updated: Jun 17, 2017, 07:11 GMT+00:00

The German index gapped higher at the open on Friday, as the €12,700 level looks likely to offer a bit of support. The market has been very volatile as of

The German index gapped higher at the open on Friday, as the €12,700 level looks likely to offer a bit of support. The market has been very volatile as of late, but I see longer-term support below as well, so I don’t have any interest in shorting the DAX as it should lead the rest of the European Union higher overall. Given enough time, I suspect that we will probably reach towards the €13,000 level, but obviously that will take some time to get there. Pullbacks offer value, and I don’t see that changing anytime soon as the DAX attracts so much money when traders are looking to invest in the European Union. Ultimately, I believe that the DAX will retain its longer-term uptrend, and because of that I don’t think that shorting will be in your best interest, even though we will have selling opportunities occasionally.

The gap should support

The gap from the Friday open should continue to support this market, as we have pullback to fill it already, and then bounced from there. I believe in the longer-term viability of the DAX in general, and I think that the next target will be somewhere closer to the €12,800 level above. Given enough time, I think we break above there and go to the next major level, the €12,900 level. It’s not to say that it will be easy to get there, but I think given enough time that’s exactly what happens. Look for short-term pullbacks on short-term charts to take advantage of what seems to be mounting bullish pressure in this market. If we did breakdown below the €12,500 level underneath, the market should then go to the €12,000 level, but that is the least likely of scenarios that I see.

DAX Video 19.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement