Advertisement

Advertisement

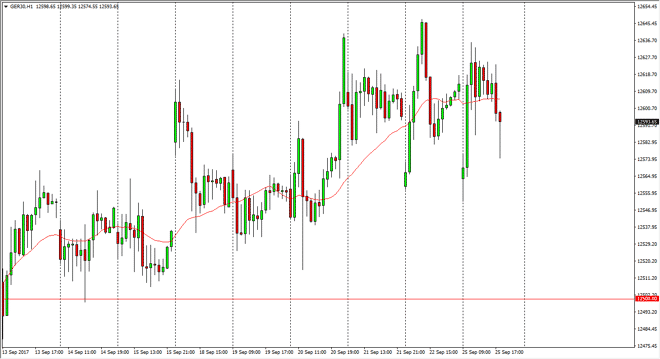

DAX Price Forecast September 26, 2017, Technical Analysis

Updated: Sep 26, 2017, 05:03 GMT+00:00

The German index had a volatile session, initially gapping lower after the election results on Monday, rallying significantly, and then pulled back to

The German index had a volatile session, initially gapping lower after the election results on Monday, rallying significantly, and then pulled back to test that gap again. It held true, and it now looks as if we will probably continue to see bullish pressure over the longer term. I don’t think that this market is in any serious trouble, and if anything, we may find ourselves going sideways over the next several sessions. I believe that the pullbacks are buying opportunities, and given enough time the market will probably go looking towards the €12,750 level. The €12,500 level underneath should continue to be support, and I think that if we can stay above there, there’s no reason to worry about where this market goes next. It doesn’t mean that it’s going to be easy to trade this market at times, but I certainly think that the overall uptrend is very much intact, and therefore I don’t wish to fight the momentum.

Buying on the dips should continue to be the best way forward, and I believe that there are a lot of reasons to think that we may see volatility. Because of this, I think short-term buying is probably the best way to make money out of this market. Once we clear the €12,750 level, I think that it will become more of a “buy-and-hold” market at that point. Until then, I think you do what you can with the market you are given, and right now looks like a market that will continue to see choppiness more than anything else. Ultimately, I believe that selling is a great way to lose money in a market that has been so reliable as of late. Even with the volatility, by the end of the day it looks like the buyers are still very much in control.

DAX Video 26.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement