Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Price Forecast December 28, 2017, Technical Analysis

Updated: Dec 28, 2017, 05:05 GMT+00:00

US stock markets did very little during the trading session on Wednesday, as quite frankly there is an enough volume out there to push the futures markets around. Obviously, the CFD markets follow suit, and with this I think it’s probably going to be a few days before we get a significant move.

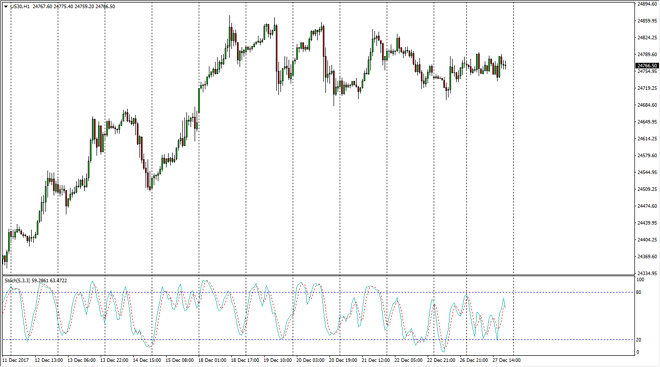

Dow Jones 30

The Dow Jones 30 went sideways of course, but I think the most important level at this point is the 24,700 level, as it is a bit of a “floor. If we can bounce from there, the market should then go to the 24,850 level which has been a bit of a ceiling. I believe that the choppiness continues to offer potential opportunities, but for short-term traders only. I would stick to a very tight range, and perhaps use the stochastic oscillator as a signal as well. Overall though, you would not be blamed for sitting on the sidelines as there is a much going on.

Dow Jones 30 and NASDAQ Index Video 28.12.17

NASDAQ 100

The NASDAQ 100 was very quiet initially during the trading session, but then eventually settled on a slightly negative session. I believe that the 6400-level underneath is the “floor” in the market, and looking at the stochastic oscillator it’s likely that we will go looking towards that area. Otherwise, we could turn around towards the 6450 handle, but at this point in the year, it’s very difficult put on large position, but I do recognize that the NASDAQ 100 is bullish overall and longer term, so I believe that the attitude of this market will continue to be the same going into 2018, so if you are more of a longer-term trader, you may be able to start building up a position slowly and add as it works out in your favor.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement