Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Price Forecast February 13, 2018, Technical Analysis

Updated: Feb 13, 2018, 04:40 GMT+00:00

The US stock markets had a positive session on Monday, as traders jumped back to work. The market looks as if it has calmed down from the recent selling off, so I think that the so-called “smart money” is starting to pick up value as it finds it.

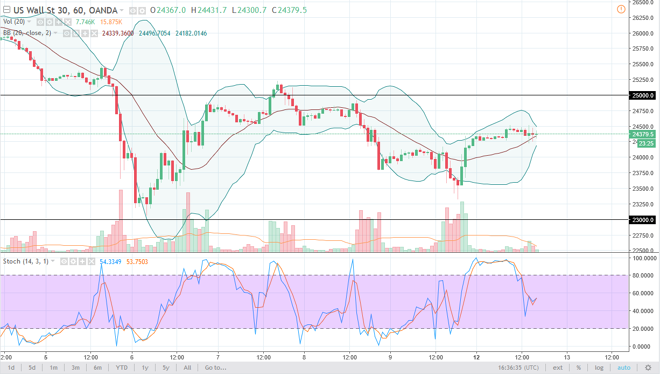

Dow Jones 30

The Dow Jones 30 initially rally during the day on Monday, and then went sideways for several hours. It looks as if the value hunters are back out in full force, and it’s likely that we are going to go looking towards the 25,000 level once we clear the 24,500 level. If we can break above the 25,000 level, the market is free to go much higher. I like the idea of buying dips, but I would do so in small increments, giving yourself some wiggle room as the recent selloff will of course made a lot of traders very nervous. However, as they say – “buy when there is blood in the streets.”

Dow Jones 30 and NASDAQ Index Video 13.02.18

NASDAQ 100

As I record this video, the NASDAQ 100 is testing the vital 6500 level. I think that we will eventually break above that level and end up going towards the 6600 level. Above that level, the 6700 level will be targeted, and perhaps even beyond. I would not be surprised at all to see this market revisit the 7000 level and the next several days, as I think a lot of the selloff was done out of panic more than anything else. I think that the 6200-level underneath is a bit of a floor, and if we break down below there the next area will probably be 6000 that offers buying pressure. I like the idea of buying the NASDAQ 100, as I do most stock markets around the world right now.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement