Advertisement

Advertisement

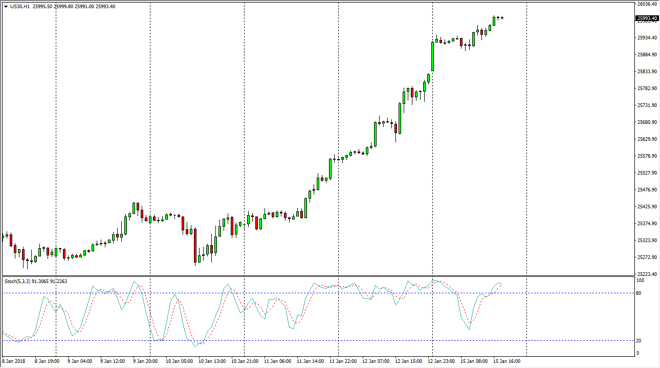

Dow Jones 30 and NASDAQ 100 Price Forecast January 16, 2018, Technical Analysis

Updated: Jan 16, 2018, 05:41 GMT+00:00

The US stock markets of course were close during the trading session on Monday, as it was the Martin Luther King Junior holiday. Because of this, any trading that has occurred was due to CFD trading, and not the stock markets.

Dow Jones 30

Dow Jones 30 traders rally during the trading session on Monday, but keep in mind that the underlying index wasn’t open, so this is the retail trader looking to go long in this market longer term. I think that pullbacks will continue to be buying opportunities as we approach the 26,000 level. That’s an area that will continue to be massively resistive, so don’t expect much in the way of explosive momentum to the upside, least not until the real traders come back. Look at pullbacks as value, as we have seen so much in the way of bullish positivity.

Dow Jones 30 and NASDAQ Index Video 16.01.18

NASDAQ 100

The NASDAQ 100 rallied initially during the day, but then went sideways overall. I believe that pullbacks continue to offer buying opportunities as the 24-hour exponential moving average has offered support. I think that the market continues to go much higher, but we may need to pull back in order to find enough value. Longer-term, I think if we break above the 6800 level, the market probably goes to the 6900 level and then finally my longer-term target, the 7000 level. I don’t have any interest in shorting this market, I think there is more than enough support underneath, especially at large, round, psychologically significant handle such as the 6700 handle. Traders simply are not letting stock markets pulled back significantly anymore, so algorithms jump into the market and start buying. I think that continues to be the case in the meantime.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement