Advertisement

Advertisement

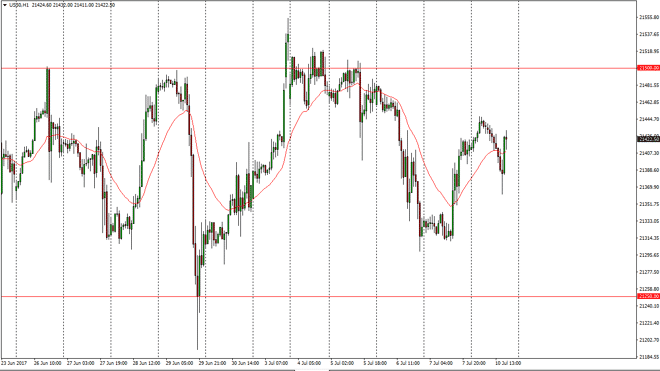

Dow Jones 30 and NASDAQ 100 Price Forecast July 11, 2017, Technical Analysis

Updated: Jul 11, 2017, 05:46 GMT+00:00

Dow Jones 30 The Dow Jones 30 initially tried to rally during the day on Monday, but turned around at the 21,450 level to fall significantly. However,

Dow Jones 30

The Dow Jones 30 initially tried to rally during the day on Monday, but turned around at the 21,450 level to fall significantly. However, buyers reentered the market as the Americans continue to look bullish in general. As you can see on Friday, the bullish pressure came during the US trading session, and it looks as if they are most certainly likely to continue to aim for higher levels. I believe that there is buying opportunities underneath as it seems to be so resilient. If we can break above the 21,500 level, the market should continue to go even higher, continuing to follow the uptrend that we have been in for some time. However, lately we been consolidating, so break above the 21,500 level is not only continuation of the longer-term, but it is also a bullish sign has it would show a pickup and momentum.

Dow Jones 30 and NASDAQ Index Video 11.7.17

NASDAQ 100

The NASDAQ 100 went sideways in general, as Monday was quiet. However, later in the day we saw a lot of bullish pressure, and it looks likely that were going to reach towards the 5700 level. If we can break above there, the market should go much higher, probably reaching towards the 5750 level, and then eventually 5800. The NASDAQ 100 looks as if it is trying to form some type of larger rounding patter on the bottom of a move lower, and I believe that the NASDAQ 100 looks likely to try to break out. If we do, I don’t see the reason we don’t continue to go much higher. Selling isn’t a thought, least not until we break down below the 5550 handle. One thing I think you can count on is choppy trading conditions as markets churn.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement