Advertisement

Advertisement

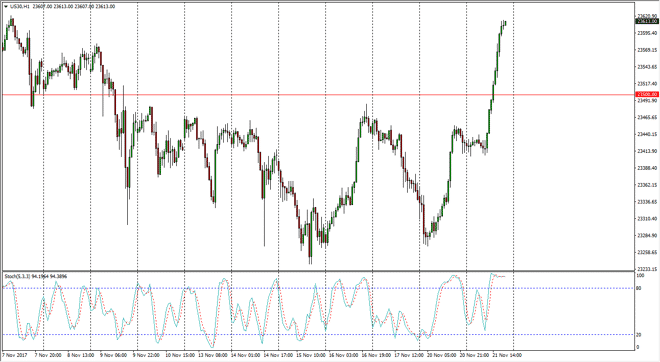

Dow Jones 30 and NASDAQ 100 Price Forecast November 22, 2017, Technical Analysis

Updated: Nov 22, 2017, 05:19 GMT+00:00

Dow Jones 30 The Dow Jones 30 exploded to the upside during the trading session on Tuesday, slicing through the 20,500 level. The market then broke above

Dow Jones 30

The Dow Jones 30 exploded to the upside during the trading session on Tuesday, slicing through the 20,500 level. The market then broke above the 23,600 level, and I think that we are getting a bit overextended as we try to break out to the upside. Pullbacks to the 23,500 level are possible, but I think that should be plenty of buyers in that area and therefore it’s likely that we continue to see the Dow Jones 30 rally over the longer term. US stocks have been very strong for some time, and I think that it’s unlikely to change anytime soon, although we could get a bit of a pullback from time to time I have no interest in shorting, and given enough time I think that we will reach towards the 24,000 handle.

Dow Jones 31 and NASDAQ Index Video 22.11.17

NASDAQ 100

The NASDAQ 100 has broken to the upside, reaching a fresh, new high. Ultimately, the market looks as if it is a bit overextended as I record this, but quite frankly I think that the pullback will be bought. I’m looking at the 6340 level for buying opportunities, and I believe that we will eventually go to the 6400 level. If we were to break down below the 6300 level, it would be very negative, but in the meantime, I think that the buyers are more likely than not to take over the market and push towards higher levels. Longer-term, I anticipate a significant move and attempt to reach the 6500 level above. Volatility will continue, but in general I believe that the buyers will have the upper hand, as the NASDAQ 100 tends to lead the rest the American stock markets higher. As we head towards the end of the year, the “Santa Claus rally” seems to be winding up.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement