Advertisement

Advertisement

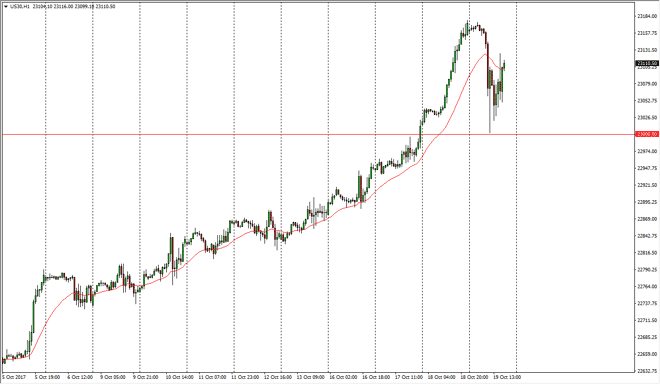

Dow Jones 30 and NASDAQ 100 Price Forecast October 20, 2017, Technical Analysis

Updated: Oct 20, 2017, 05:58 GMT+00:00

Dow Jones 30 The Dow Jones 30 rolled over during the day on Thursday, slamming into the 23,000 level but finding enough buyers there to turn around and

Dow Jones 30

The Dow Jones 30 rolled over during the day on Thursday, slamming into the 23,000 level but finding enough buyers there to turn around and rally again. You can see that the rally was based around American trading, which is a good sign, considering it is the bulk of the volume. It’s also a good sign that the 13,000 handle held up, as it was previous resistance, this makes sense that it is a continuation of the longer-term uptrend, and therefore I am bullish of the Dow Jones 30 and I think that the market will probably go to the 23,200 level again rather soon. I have no interest in shorting, least as long as we can stay above the 22,000 handle, which should now be a bit of a “floor” in the market.

Dow Jones 30 and NASDAQ Index Video 20.10.17

NASDAQ 100

The NASDAQ 100 took a massive hit at the open on Thursday, reaching down to the 6050 handle, but just like the Dow Jones 30, found plenty of support at the psychologically important barrier. This is an area that’s been supportive several times in the past, and it looks like the Americans are willing to pick up value in this area. I believe that as long as we can stay above the 6000 handle, it’s likely that the uptrend will be completely intact, and eventually we should go higher. If we were to break down below the 6000 level, I would then become concerned. Until then, this is a “buy the dips” market, and this should offer value. Longer-term, I still believe that we go to the 6200 level, and even with a massive selloff during the day on Thursday, my analysis of that has not changed yet.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement