Advertisement

Advertisement

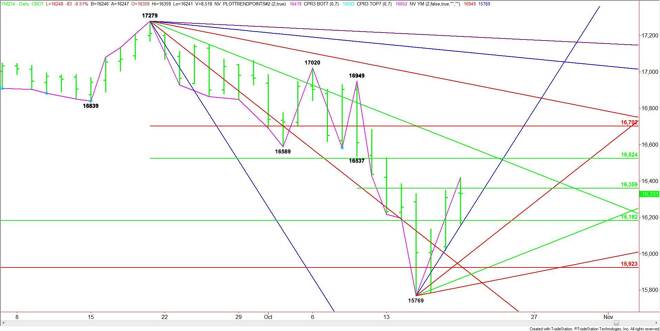

E-mini Dow Jones Industrial Average (YM) Futures Analysis – October 21, 2014 Forecast

By:

The December E-mini Dow Jones Industrial Average futures contract posted a small gain on Monday, but the move was good enough to make 15769 a new main

The December E-mini Dow Jones Industrial Average futures contract posted a small gain on Monday, but the move was good enough to make 15769 a new main bottom.

The short-term range is 16949 to 15769. The 50% level of this range at 16359 is currently being tested. This price could act like a short-term pivot. Since the main trend is down, sellers may try to use it to re-enter the market. Buyers on the other hand may want to use it as a launching pad for the next rally.

The main range is 17279 to 15769. Its retracement zone at 16524 to 16702. This is the most likely upside target. A major downtrending angle from the 17279 top passes through this range at 16575, making it a valid upside target also. Since the main trend is down, sellers may show up in this zone to defend the trend.

On the downside, the nearest support is a steep uptrending angle from the 15769 bottom at 16281. Breaking this angle will be a sign of weakness.

The next support is a major 50% zone at 16182. The Dow could accelerate to the downside if this price fails with the next potential target another uptrending angle at 16025.

The tone of the market today is likely to be determined by trader reaction to the short-term pivot at 16359.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement