Advertisement

Advertisement

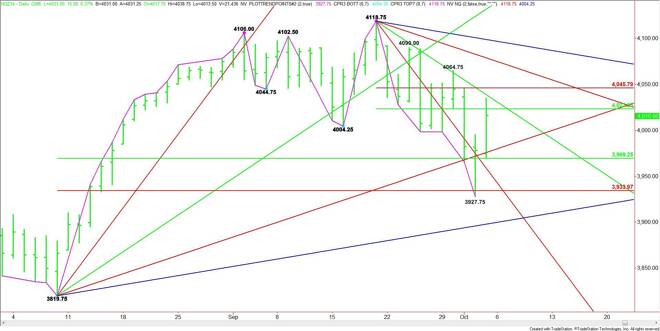

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – October 6, 2014 Forecast

By:

December E-mini NASDAQ-100 Index futures surged on Friday, closing near its high, but finding resistance at the key retracement zone that will decide

December E-mini NASDAQ-100 Index futures surged on Friday, closing near its high, but finding resistance at the key retracement zone that will decide whether the index goes higher, or forms another lower top and starts another leg down.

The main trend is down on the daily chart. The main range is 3819.75 to 4118.75. Its retracement zone at 3969.25 to 3934.00 provided the support last week that launched Friday’s strong rally.

The short-term range is 4118.75 to 3927.75. Its retracement zone at 4023.25 to 4045.75 was tested on Friday. Today, investors will go after this zone again. Trader reaction to this zone will set the tone for the session.

The rally will either stop in this zone and form a potentially bearish secondary lower top, or chew through it on the way to a possible test of the contract high or perhaps a new high.

A downtrending angle from the 4118.75 top drops in at 4030.75. This angle passes through the key retracement zone, making it a valid resistance/breakout point.

A sustained move through the Fibonacci level at 4045.75 should create enough upside momentum to reach the next angle at 4074.75. This is followed by another angle at 4096.75.

If the rally fails at 4023.25 then look for the start of a possible correction back to the nearest support angle at 3979.75.

Focus on the order flow and price action at 4023.25 to 4045.75. Holding inside this zone will indicate trader indecision. Taking out 4045.75 with conviction will be bullish. A failure at 4023.25 will be bearish.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement