Advertisement

Advertisement

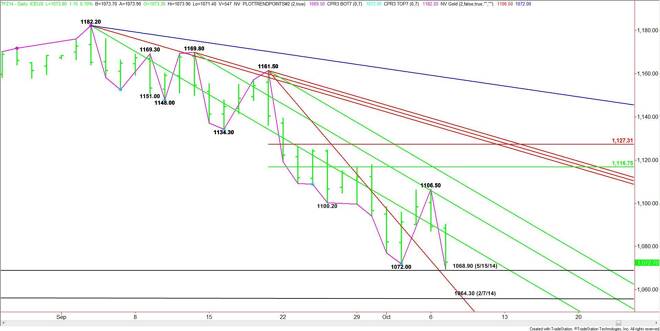

E-mini Russell 2000 Index (TF) Futures Technical Analysis – October 8, 2014 Forecast

By:

December E-mini Russell 2000 Index futures broke sharply on Tuesday, taking out the last main bottom at 1072.00, reaffirming the main downtrend. The price

The weak close put the market on the bearish side of a downtrending angle from the 1182.20 top. This angle could provide resistance today at 1182.20. This is followed by the next downtrending angle at 1097.80. The distance between these angles suggests volatility.

The close also put the index in a position to take out the May 15 bottom at 1068.90. This could lead to an acceleration to the downside with the February 7 bottom at 1064.30 the next likely target. This price is the low of the year so taking it out with conviction will mean the Russell is in a bear market. The next downside target under this level is 1057.60, followed by a steep drop-off to the next support at 1017.70.

The tone of the day is likely to be determined by trader reaction to 1068.90. The index may straddle this level several times today as bearish sellers and bullish value-seekers battle it out for control.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement