Advertisement

Advertisement

EUR/USD Daily Forecast – Euro Extends Recovery Ahead of Fed Meeting

By:

EUR/USD has erased a bulk of the losses that followed Friday's jobs report and is closing in on December highs ahead of today's Fed meeting.

Federal Reserve Announces Rate Decision Later Today

The Federal Reserve will announce its latest rate decision which should cause some volatility in the markets. Ahead of it, the markets will get a look at how inflation is evolving in the US as the latest CPI figures are scheduled for release.

The Federal Reserve signaled at their last meeting that they don’t intend to cut rates any further, at least any time soon. At the same time, they communicated that the bar was quite high for a near-term rate increase. Therefore it is largely expected that the Fed does not act today, however, forward guidance will be important and stands to move the markets.

Volatility is likely to be seen in the dollar later today as a result of the two releases. The greenback has traded a bit heavy in the early week, and the US dollar index (DXY) trades near its monthly low.

Technical Analysis

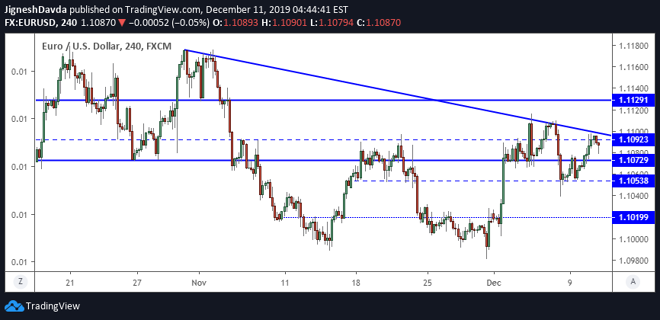

With the low volatility in the markets these days the question is if today’s fundamental events will trigger enough pressure for a technical breakout.

The pair bounced early in the week after it tested a support confluence of the 50 and 100-day moving average. The pair is now trading against resistance.

Resistance in EUR/USD stems from a horizontal level at 1.1090 with further resistance just above it from a trendline drawn originating from the late November high.

This currently defines a range between roughly 1.1060 and 1.1100. I suspect a range break either way will stand to have some follow-through.

In terms of momentum, the exchange rate has mostly shown a bias for moving to the upside. The exception was on Friday when it declined after the US jobs report came in ahead of exceptions. Ultimately, the direction from here will depend on the Fed meeting and CPI report, but the price action for the month thus far slightly favors more upside.

In the even the pair moves higher from here, the next main area of interest I am watching falls at 1.1129.

Bottom Line

- EUR/USD holding within a range between 1.1060 and 1.1090 in the early week.

- There is potential for a breakout on the back of today’s CPI release and Fed meeting.

About the Author

Jignesh Davdaauthor

Jignesh has 8 years of expirience in the markets, he provides his analysis as well as trade suggestions to money managers and often consults banks and veteran traders on his view of the market.

Advertisement