Advertisement

Advertisement

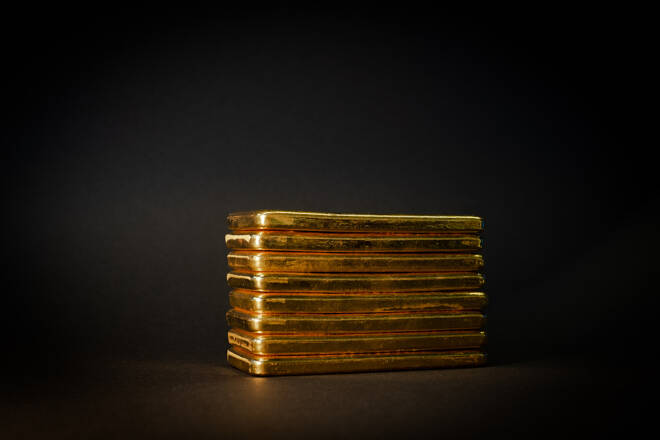

Fed Minutes Result in Higher Treasury Yields Taking Gold Lower

By:

Higher yields placed strong pressure on gold prices today and inversely strengthened the US dollar.

Surge in US Bond Yields: FOMC Meeting Minutes Trigger Major Sell-Off and Dollar Strengthening

The release yesterday of the minutes from the July FOMC meeting sparked a major selloff in US bonds and notes taking yields to their highest levels since 2011. Yields on longer-dated US debt instruments such as the 10-year note and 30-year bonds moved to their highest closing level in years. Yield on the 10-year government treasuries rose by 4.9 basis points from 4.258% to 4.307% when compared to the yields yesterday. That takes yields on 10-year US debt instruments to the highest level since 2007.

A similar trend can be seen in the longer-term 30-year Treasury Bonds which rose 5.2 basis points. Current yields have risen to 4.411%. Compared to yields before the release of the FOMC meeting minutes yesterday of 4.359%, the 30-year bond is at its highest level since April 2011.

The dramatic rise in longer-term US debt instruments can be directly tied to statements revealed in the minutes from the July FOMC meeting indicating that the Federal Reserve will most likely continue to have a restrictive monetary policy which most likely will include an additional rate hike of ¼% this year. The Federal Reserve continues to be laser-focused on the reduction of inflationary pressures in the United States and recent economic data indicates that the robust GDP growth provides the Federal Reserve with more latitude in their aggressive actions. The Fed’s goal continues to be to take core inflation down to its target of 2%.

Higher yields placed strong pressure on gold prices today and inversely strengthened the US dollar. Yesterday, spot gold broke below $1900 a key and significant psychological price point. Selling continued in spot (Forex) gold today with the current price of $1888.80 down $3.11 from yesterday’s close. Gold futures had a much greater percentage decline. As of 5:08 PM EDT, the most active December futures contract is down $9.40 and fixed at $1918.90 after trading to a low of $1914.20.

The rise in the dollar continued with a fractional gain today of 0.01% taking the dollar index to 103.33.

Divergence of Gold and Silver Pricing Widens

The tandem nature of gold and silver has dramatically unwound recently. Today, for example, silver futures had a strong increase of almost a full percentage point while. Silver futures basis the most active September contract gained $0.91 and took current pricing to $22.74.

Silver’s recent decline resulted in a larger percentage decline than gold’s correction, however, they both moved lower in tandem. The opposite has occurred today with gold pricing continuing to erode and silver experiencing a strong upside bounce.

For those who would like more information simply use this link.

Wishing you as always good trading,

Gary S. Wagner

About the Author

Gary S.Wagnercontributor

Gary S. Wagner has been a technical market analyst for 35 years. A frequent contributor to STOCKS & COMMODITIES Magazine, he has also written for Futures Magazine as well as Barron’s. He is the executive producer of "The Gold Forecast," a daily video newsletter. He writes a daily column “Hawaii 6.0” for Kitco News

Advertisement