Advertisement

Advertisement

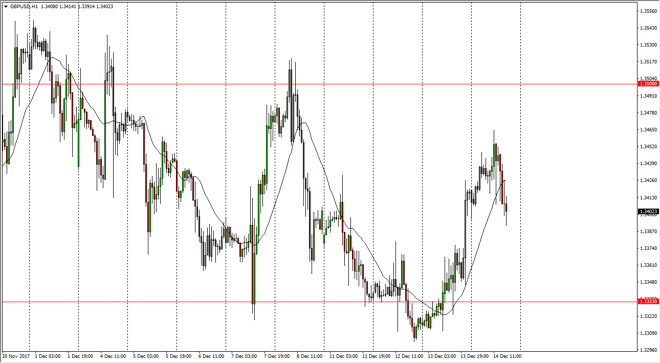

GBP/USD Price Forecast December 15, 2017, Technical Analysis

Updated: Dec 15, 2017, 06:28 GMT+00:00

The British pound continues to be very noisy, initially rally during the day on Thursday, but then pulled back rather significantly. Towards the end of the day though, we started to see buyers jump back in.

The British pound has fallen significantly during the trading session after initially tried to rally. However, after the Bank of England announcement, it seems as if the Americans were willing to pick up the ball again, especially near the 1.34 handle. Because of this, I think that the market is going to go to the 1.35 handle above, which is a large, round, psychologically significant number. If we can break above that level, then I think we go looking towards the 1.3650 level above, which is a massive gap and therefore a major target from what I see. If we can break above that level, then it becomes a “buy-and-hold” situation. The market has been jumping around significantly, and of course there are a lot of headlines the can move the British pound currently, as we continue the discussions between the European Union and the United Kingdom. Because of this, the pair will be somewhat headline driven, but wanting to pay attention to is that inflation and the United Kingdom has been rising rapidly. In fact, we just hit a six-year high. This is typically good for interest rates going higher, which of course is good for the British pound.

I believe that the floor in the market is close to the 1.3333 handle, and if we can stay above there, the market is essentially going to be a “buy on the dip” type of situation. If we were to break down significantly below that level, then I think we could go to the 1.31 handle, but that seems very unlikely based upon the reaction of the British pound over the last couple of sessions.

GBP/USD Video 15.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement