Advertisement

Advertisement

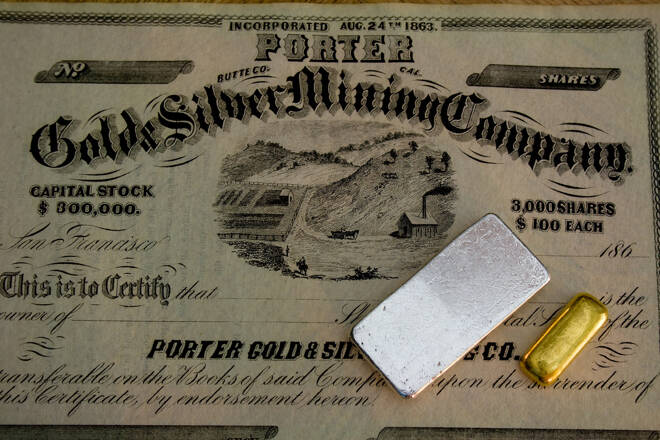

Gold Price Forecast – Gold Markets Continue to Struggle for Direction

Published: Jan 10, 2022, 16:06 GMT+00:00

Gold markets initially tried to rally during the trading session on Monday but have given back gains rather quickly as we continue to be mired in sideways action.

Gold markets have initially tried to rally during the trading session on Monday but seem to be stuck right around the 50 day EMA. Because of this, it will be interesting to see where we moved next but if we can break down below the bottom of the hammer from the trading session on Friday, that opens up fresh selling and could send this market much lower. All things been equal, this is a market that I think will eventually have to make a bigger decision, but right now it seems as if it is simply willing to go back and forth right around the 50 day EMA.

Gold Price Predictions Video 11.01.22

To the upside, if we were to break above the $1800 level on a daily close it is possible that we could take off to the upside, opening up the possibility of a move back towards the $1830 level. I do not necessarily think that is going to be the easiest trade to make, but it would simply continue to be more chop than anything else. This makes quite a bit of sense due to the fact that we have a lot of noise coming from the 10 year note, which of course has a major influence on what happens with precious metals.

All things been equal, I think if you are a short-term range bound trader this might be your market over the next couple of weeks. That being said, if we do get a move below the candlestick on Friday, then it is very likely we go looking towards the $1750 level underneath. To the upside, I believe that 1830 is going to be very difficult to break above.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement