Advertisement

Advertisement

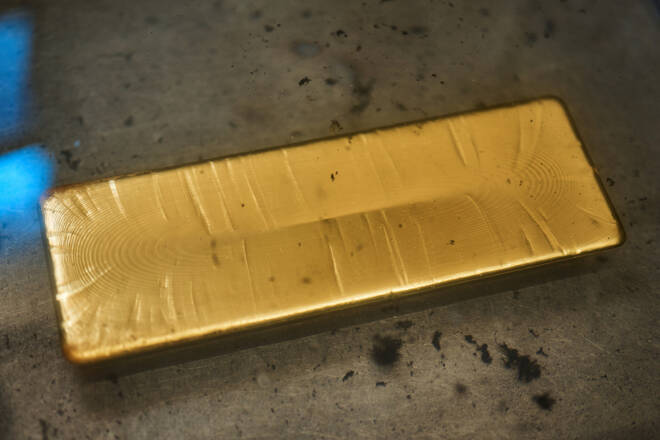

Gold Price Forecast: XAU Rises as Dollar Weakens, But High Rates Cap Gains

By:

Gold (XAU) prices edge higher on weaker dollar as investors await consumer price inflation data and Federal Reserve interest rate decision.

Highlights

- Gold prices rise due to weaker dollar and anticipation of Fed decision.

- U.S. consumer inflation report for May to provide clearer economic picture.

- Market focuses on inflation amid expectations of Fed pause.

Overview

Gold (XAU) prices are edging higher on Thursday, buoyed by a weaker dollar, while awaiting cues from the U.S. Federal Reserve. Although gold remained near the previous session’s lows, support from expectations of the Fed holding rates next week provided some optimism. Currently trading in the range of $1,917.41 to $1,992.40, bullion could potentially breach the upper range once the U.S. central bank decision is announced.

Fed Expected to Hold Rates, CPI Report Key

Economists polled by Reuters anticipate that the Fed will refrain from raising interest rates for the first time in over a year at its June 13-14 meeting. However, the U.S. consumer inflation report for May, scheduled for release on June 13 ahead of the Fed meeting, will offer investors a clearer picture of the world’s largest economy’s health. U.S. Treasury Secretary Janet Yellen acknowledged that while the U.S. economy displays strength with robust consumer spending, certain sectors are experiencing a slowdown. Yellen expressed her expectation of continued progress in curbing inflation over the next two years.

Gold Prices Dip as Bond Yields Rise

On Wednesday, gold prices experienced a 1% decline as U.S. bond yields rose. Investors are eagerly awaiting upcoming inflation data and the Federal Reserve policy meeting for insights into the direction of U.S. interest rates. The recent decision by the Bank of Canada to raise interest rates to a 22-year high of 4.75% could potentially impact the Fed’s stance.

Rate Hike Predicted Amid Inflation Concerns

Market analysts predict another rate hike next month to address concerns about an overheating economy and persistent high inflation. Inflation remains a significant focus in the market. While the expectation is for the Fed to pause, if inflation remains elevated, it could lead to a change in outlook. Despite a slight easing in the dollar index, which makes gold more affordable for investors using other currencies, the appeal of zero-yield bullion continues to diminish due to higher interest rates.

Citi Lowers Gold Price Target

Citi, in a note, reduced the 0-3 month gold point-price target to $1,915 from $2,100, indicating that the bullish trend in the bullion sector will re-emerge before the end of 2023. Despite a hawkish Fed regime, Citi affirms that gold remains a viable macro portfolio tail hedge.

Cautious Trade Ahead of CPI, Fed

In conclusion, gold prices have seen a modest rise, supported by a weaker dollar, while investors eagerly await signals from the U.S. Federal Reserve. With expectations of the Fed holding rates, the market awaits the U.S. consumer inflation report for May to gain a better understanding of the economy.

The recent hike in U.S. bond yields and the Bank of Canada’s interest rate decision have also contributed to the market’s focus on inflation. While a pause in rate hikes is anticipated, persistent high inflation could lead to a shift in outlook. The affordability of gold for investors holding other currencies, coupled with Citi’s projection of a re-emerging bullish trend, suggests that gold remains an attractive option despite the current Fed regime.

Technical Analysis

Gold (XAU) is trading on the bearish side of $1992.24 (PIVOT), putting it in a weak position. However, it’s also trading on the strong side of $1917.41 (S1). The mid-point of this range is $1954.83. Early Thursday, the market is on the weakside of the mid-point, suggesting the return of sellers.

A sustained move over the $1992.24 (PIVOT) will signal the return of strong buyers. If this creates enough near-term momentum then look for a surge into the $2052.37 (R1).

Longer-term, a sustained move under $1992.24 (PIVOT) will indicate the selling pressure is still strong. If this creates enough downside momentum then look for the selling to possibly extend into $1917.41 (S1).

| S1 – $1917.41 | PIVOT – $1992.24 |

| S2 – $1857.28 | R1 – $2052.37 |

| S3 – $1782.45 | R2 – $2127.20 |

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement