Advertisement

Advertisement

Inflation Figures To Become This Week’s Market Catalyst

By:

Last week’s move by the People’s Bank of China, to cut the daily reference rate for Yuan against US Dollar by a record 1.9%, triggered the biggest plunge

Last week’s move by the People’s Bank of China, to cut the daily reference rate for Yuan against US Dollar by a record 1.9%, triggered the biggest plunge of the Chinese currency in nearly a decade. The news also damaged speculations concerning an early interest rate hike by the Federal Reserve, gifting a weekly negative close to the US Dollar Index (I.USDX) ignoring the upbeat Retail Sales and PPI numbers. The Euro region currency remained a bit strong as Greece moved closer to getting its aid funds from international creditors while the Yuan devaluation reduced import burden. Moreover, the GBP showed mixed results due to not-so-good labor market numbers and the JPY remained a bit weaker as bets supporting Japanese economy is losing momentum strengthened. The Crude prices plunged to its six years’ low and the commodity currencies, namely AUD, NZD and CAD, also registered noticeable declines.

The current week, that started with lesser than expected decline in Q2 Japanese GDP, is likely to be flourished by the Inflation numbers from UK, US and Canada. Moreover, Manufacturing and Services PMIs from China, US and Europe, coupled with the monetary policy meeting by the Bank of Japan (BoJ) and minutes of recent FOMC and RBA meetings, could become catalysts to determine this week’s forex moves. Let’s discuss these events/announcements in detail.

US CPI To Help Foresee Fed’s September Move

Even if the US economic calendar has many important events/announcements to offer during the current week, starting from Monday’s Empire State Manufacturing Index to Friday’s Flash Manufacturing PMI, the Consumer Price Index (CPI) for July 2015, scheduled for release on Wednesday, becomes an important event to determine the Fed’s much anticipated move.

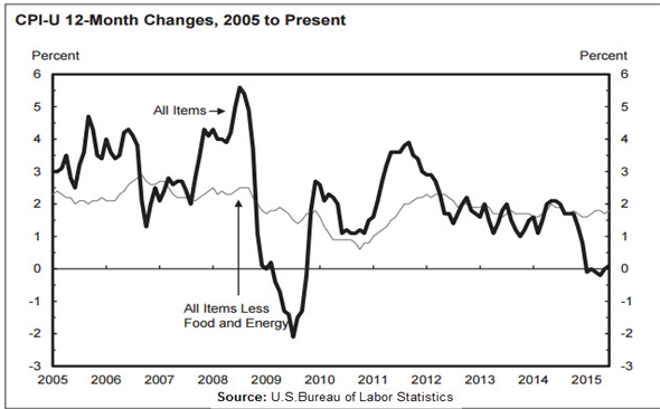

US inflation still struggles near zero mark and an announcement to hike the benchmark interest rate in September could add to the current strength of the US Dollar, providing further downside to the price index. Hence, weaker inflation number, against the expected 0.2% and the 0.3% prior, may restrict the Federal Reserve from introducing its first interest rate lift-off since 2006 during the much anticipated September meeting. Moreover, the core measure, that excludes food and energy, is likely to remain stagnant near 0.2%. A lesser than forecasted reading of which, or a plunge below 0.0% mark, can also back dissenters that don’t see interest rate change in September FOMC, providing additional weakness to the greenback.

Minutes of recent FOMC meeting, also scheduled for Wednesday release, can provide additional information on whether the US central banker is capable of altering their record low interest rates in September or not. Monetary policy meeting by the Federal Reserve, in July, wasn’t backed by the Fed Chair’s press conference and lost some of its charm; however, the FOMC statement did signal that the policy makers are welcoming the labor market improvements to trigger higher inflation and an early interest rate hike in-turn. Although, recent action by the Chinese central bank can reduce the importance of such hawkish words, even if released, and may put the emphasis back on the inflation mark to determine Fed’s next move.

Other than the headline events, Empire State Manufacturing Index, scheduled for Monday, Building Permits and Housing Starts, scheduled to be released on Tuesday, Philly Fed Manufacturing Index and Existing Home Sales, scheduled for Thursday and the Flash Manufacturing PMI, to be released on Friday, are some other details that the USD traders should take care off during the current week. Amongst them, numbers showing strength of US manufacturing activity suggest better prints, signaling strong USD in-turn, while the housing market readings are flashing mixed signals, showing inability to provide clear USD signs.

UK CPI, Retail Sales and Euro-Zone PMIs To Determine GBP & EUR Trend

With the Bank of England’s (BoE) Quarterly Inflation Report (QIR) failing to provide any clear signs of near-term interest rate hike, by cutting down the inflation outlook, monthly reading of UK CPI, scheduled for release on Tuesday, becomes an important number to forecast immediate GBP moves. The inflation gauge is expected to remain stagnant near 0.0% mark, strengthening the QIR forecast for lower medium-term inflation. Should the index disappoints market consensus, by being lower than expected, testing the negative territory, bulls supporting the BoE interest rate hike could be forced to take another setback, signaling GBP sliding downside. However, monthly Retail Sales, scheduled for Thursday, is also an important indicator to forecast near-term GBP moves. The main contributor for UK GDP, is likely reversing its prior 0.2% declines with the same amount of gain, +0.2%. Hence, an actual reading satisfying the consensus can trigger near-term GBP up-move.

Flash Manufacturing & Services PMIs for Germany and Euro-zone, scheduled for release on Friday, are the only releases that European calendar offers during the week. With the upward revision to previous readings, actual numbers surpassing the prior mark could provide additional strength to the immediate EUR moves. Moreover, focus would also be given to the Greece updates as the troubled nation is near to its scheduled EU debt payment, failing which may trim some of the recent Euro gains.

BoJ, RBA Meeting Minutes, Chinese Manufacturing PMI and Canadian Numbers

In addition to the US, UK and EU releases, minutes of recent monetary policy meeting by the Reserve Bank of Australia (RBA), scheduled for Tuesday, monetary policy meeting by the BoJ, on Thursday, and the Flash reading of Chinese Caixin Manufacturing PMI, scheduled to be released on Friday, are some other details that could make the market players busy during the current week.

Early during the month, the RBA surprised global markets by removing the term supporting necessary decline of AUD in addition to standing pat on its existing monetary policy. However, with the recent changes in Chinese front, its biggest consumer, only some of the strong phrases of the meeting minutes, supporting the delay of further interest rate cut, could restrict Australian Dollar’s downward trajectory. Moreover, earliest estimate of Chinese Caixin Manufacturing PMI, provides more detail to foresee near-term AUD moves. Even if the release is expected to surpass downwardly revised prior reading of 47.8, by being at 48.1, market players are likely to put their AUD longs only should the actual mark surpasses the 50.00 bifurcating number.

Further, monetary policy meeting by the BoJ, is likely to provide additional JPY declines as the recent GDP number reversed previous two quarters’ positive reading. However, the actual mark was lesser than the expected and a hawkish comment by the BoJ Governor, in his press conference following the meeting announcement, can help the Japanese currency recover some of its recent loses. Other than the BoJ meeting, Japanese Trade Balance, scheduled for Wednesday, becomes another important point to determine the JPY moves. The trade deficit is likely to test -0.16T mark against the previous -0.25T, providing a bit of relief to the JPY traders should the actual meets forecast.

Last but not the least, monthly details of Canadian Inflation and Retail Sales, scheduled for Friday, are important data points to help foresee near-term CAD moves. While the inflation readings, both main and the core version, are likely to remain stubborn near 0.0% mark, the retail sales figure signals weaker outlook for the Canadian currency. Moreover, the recent declines in Crude oil prices, Canada’s main export item, provided additional weakness to the Loonie, as it is nicknamed.

Follow me on twitter to discuss latest markets events @Fx_Anil

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement