Advertisement

Advertisement

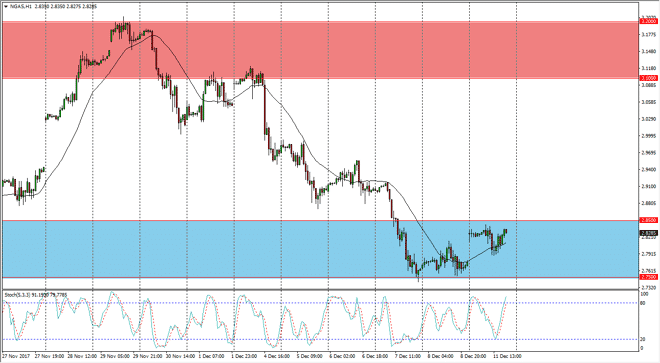

Natural Gas Forecast December 12, 2017, Technical Analysis

Updated: Dec 12, 2017, 06:05 GMT+00:00

Natural gas markets gapped higher at the open on Monday, pullback to fill that gap, and now look likely to test the $2.85 handle. Breaking above there would be a very bullish sign, and it should send this market to the top of the consolidation area.

Natural gas markets breaking above and gapping higher at the open on Monday is a very bullish sign, and that should continue to attract a lot of attention. I think that the $2.85 level being conquered by the buyers should send this market towards the $3.10 level longer term. It will take a while to get there, but at this time of year it would make sense to see a little bit of bullish pressure in the market as the colder temperatures in the United States will drive up demand, at least short-term. The cyclicality of this market is bullish during this time year typically, so these pullbacks offer value that the trading community will probably take advantage of.

As we rally, short-term pullback should be buying opportunities, but I think once we get towards the $3.10 level, there should be selling pressure and of course resistance. Ultimately, this is a market that should continue to be noisy, because quite frankly the natural gas markets typically are. I think that the area extending to the $3.20 level after that target is massively resistive. If we were to break above there, the market will probably take off to the upside and with quite a bit of momentum. Ultimately, this is a market that I think remains range bound and the longer-term range that we have been in for some time as marked by both the red and the blue areas. There are plenty of reasons to think that range bound trading systems will work.

NATGAS Video 12.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement