Advertisement

Advertisement

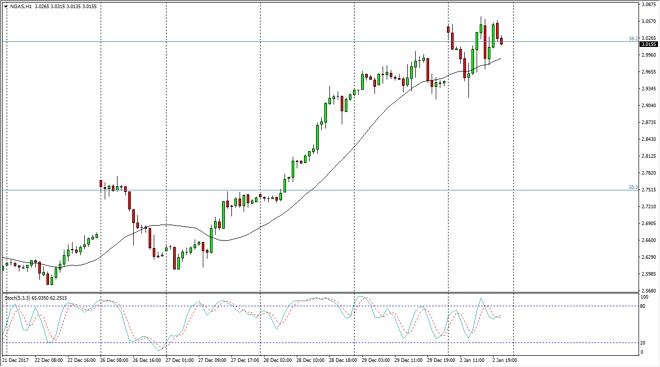

Natural Gas Price Forecast January 3, 2018, Technical Analysis

Updated: Jan 3, 2018, 07:11 GMT+00:00

Natural gas markets gapped higher at the open on Tuesday, but then pulled back to fill that very same gap. We have sent to rally, but we continue to see a lot of noise in this general vicinity, which is not a huge surprise.

Natural gas markets gapped higher at the open on Tuesday, but then pulled back to fill that gap. By filling the gap, and it looks likely that we are going to continue to find buyers, and we have in fact rallied since then. However, I think the underlying theme of this action is that the $3 level has a great influence on where we go next. In the short term, I believe that a breakdown below the $2.90 level is a sign that we are ready to roll over, and I fully think that we will eventually. Alternately, if we break above the $3.05 level, then we could go to the $3.10 level which is even more resistant. I’m looking for opportunities to sell this market, because it has not been able to pick up momentum to the upside for any significant amount of time.

If we cannot pick up momentum to the upside during the month of December, it’s unlikely that we will during the month of January as well. Rallies at this point look to be short-term at best, and simply opportunities to short the market from a higher timeframe. The $2.75 level underneath is going to continue to be supportive, and perhaps the target. That being said, wait for signs of exhaustion on the rallies to start shorting. I don’t have any interest in trying to buy this market, I have been sold more than once this winter about the market being strong enough to continue to the upside.

NATGAS Video 03.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement