Advertisement

Advertisement

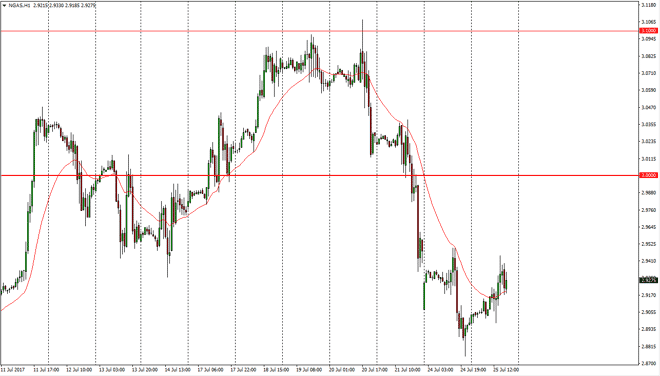

Natural Gas Price Forecast July 26, 2017, Technical Analysis

Updated: Jul 26, 2017, 04:41 GMT+00:00

The natural gas markets rose a bit during the day on Tuesday, as we continue to see a little bit of a bounce. However, there is more than enough

The natural gas markets rose a bit during the day on Tuesday, as we continue to see a little bit of a bounce. However, there is more than enough resistance above to think that we are going to have any real impression to the upside, and I believe that the $3.00 level above continues to be massive resistance. Because of this, I am a seller on signs of exhaustion, and I believe that the $3.00 level will be the beginning of massive resistance that extends to the $3.10 level. Ultimately, this is a market that is a “salon the rallies” type of situation, so I look at these moves to the upside as an opportunity to get involved yet again at a higher price. I believe that working to go looking for the $2.85 level below, and then eventually the $2.7 level after that. I have no interest in buying, and believe that the oversupply continues to be a massive issue when it comes to natural gas in general. I am a seller, and will remain so.

Although the market is very volatile, the reality is that it’s a market that has been in a downtrend for several years. Yes, we have seen a bit of a rally from time to time, but those always seem to be selling opportunities if you are patient enough to wait for the move. If we can break down below the $2.85 level, I think that adding to your short position might be the best way to go, as it would show a significant break down of support again. It is not until we break above the $3.10 level that I would be concerned about the negative pressure in the market that has been such a mainstay of my trading strategy.

NATGAS Video 26.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement