Advertisement

Advertisement

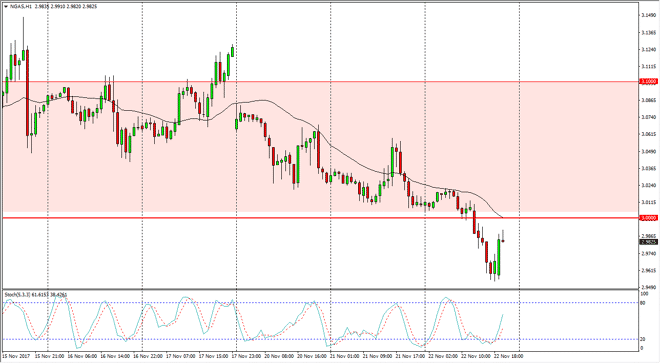

Natural Gas Price Forecast November 23, 2017, Technical Analysis

Updated: Nov 23, 2017, 05:01 GMT+00:00

The natural gas markets went sideways initially on Wednesday, but then broke down below the $3 level. We dropped to the $2.95 level, before bouncing, and

The natural gas markets went sideways initially on Wednesday, but then broke down below the $3 level. We dropped to the $2.95 level, before bouncing, and it now looks as if we are starting to see resistance near the $3.00 level again and the 24-hour exponential moving average. Overall, this is a market that is rather perplexing, as the volatility is getting worse, not better. The fact that we have bounced to the $3.00 level and have rolled over a bit suggests that we are more than likely going to continue to see sellers enter this market. Now that we have broken down, we could go as low as the $2.85 level underneath, which has been support. The fact that we have done this is quite surprising, because quite frankly the temperatures in the United States get colder this time year, and therefore tend to drive up demand. Typically, we have a lot of buying pressure. The seasonality not working is a bit surprising, but longer-term I have been bearish of natural gas anyway. At this point, it’s not until we break above the $3.10 level that I would be a buyer again, and this is the second time late in the year that I have seen the buyers get fake doubt, myself included. I recognize that there is a gap above at the $3.10 level, so that’s why breaking above there would make such a huge impression.

In general, I think that you should be very cautious about training natural gas over the next couple of sessions, as although there will be some electronic trading, the reality is that a majority of natural gas gets traded in the United States, which of course is going to be celebrating the Thanksgiving holiday.

NATGAS Video 23.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement