Advertisement

Advertisement

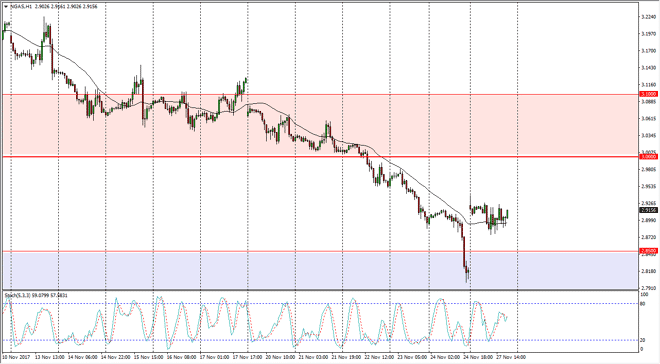

Natural Gas Price Forecast November 28, 2017, Technical Analysis

Updated: Nov 28, 2017, 05:26 GMT+00:00

Natural gas markets gapped higher at the open on Monday, reaching as high as $2.94, pulling back, finding buyers, and bouncing again. This makes a lot of

Natural gas markets gapped higher at the open on Monday, reaching as high as $2.94, pulling back, finding buyers, and bouncing again. This makes a lot of sense, because the $2.85 level was so massively supportive in the past, that it of course would attract a lot of buying. That being the case, it makes sense that we would bounce a bit. I think that the $3 level above is massively resistive though, and the beginning of a significant resistance barrier to the $3.10 level, so I’m simply waiting for some type of exhaustion that I can start selling based upon a roll over, or perhaps a crossover in the overbought part of the Stochastic Oscillator. It’s not until we would break above the $3.10 level that I would think the buyers could take control again, and the volatility in this natural gas market is quite stunning, and will keep a lot of people away from the markets.

That should make for a relatively thin market at times, and although we seasonally have quite a bit of bullish pressure in this market right now, the reality is that rolling over the way we have signifies just how bearish this market truly is. With colder temperatures in the United States, that typically brings in higher pricing, but the oversupply continues to be a major issue and I believe continues to cause a lot of problems for the buyers. I am simply on the sidelines and waiting for an opportunity to start selling and what has been a very negative market over the last several years. I do not think that we can break down below the $2.75 level though, and I think that is essentially the “floor” in the market through the rest of winter.

NATGAS Video 28.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement