Advertisement

Advertisement

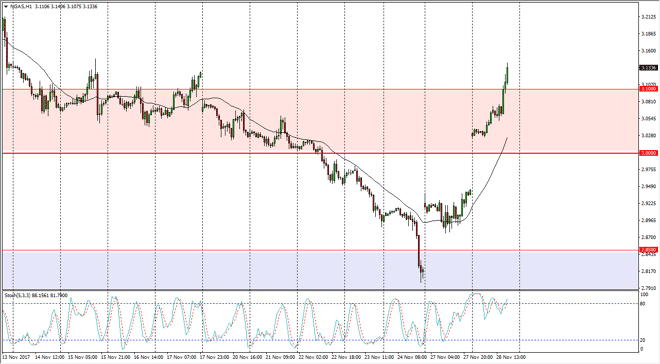

Natural Gas Price Forecast November 29, 2017, Technical Analysis

Updated: Nov 29, 2017, 09:41 GMT+00:00

The natural gas markets gapped higher at the open on Tuesday, breaking above the $3 handle. Again, natural gas has proven itself to be thin and illiquid

The natural gas markets gapped higher at the open on Tuesday, breaking above the $3 handle. Again, natural gas has proven itself to be thin and illiquid and dangerous to say the least. We have broken above the $3.10 level, which was an area that I expected to be massively resistive. That being said, I think that the next 24 hours a going to be very important, and therefore it’s important to pay attention to where we close the day on Tuesday. If we break down below the $3.10 level, I think we will probably try to fill the gap, perhaps driving down to the $2.95 level underneath. A break above the highs of the day should send this market much higher, perhaps looking towards the $3.25. This is a very difficult market to trade right now, because it has been so massively volatile.

Longer-term, we have been in a downtrend, so it makes sense that we would roll over sooner rather than later, and as I look at the hourly chart it looks as if trouble is already starting to stir. We are in the overbought part of the Stochastic Oscillator, and looking like we might be trying to try to crossover. If we get that, then it’s a decent signal. One of the biggest problems that we have in this market is that temperatures in the United States have been erratic, and that of course as to the seasonality of natural gas in general. Having said that, the oversupply has worked in the other direction, so we should continue to see very choppy conditions. Stick to the CFD markets and small positions, but I think we will probably see some type of rollover relatively soon. Either way, natural gas is not an easy market to trade these days.

NATGAS Video 29.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement