Advertisement

Advertisement

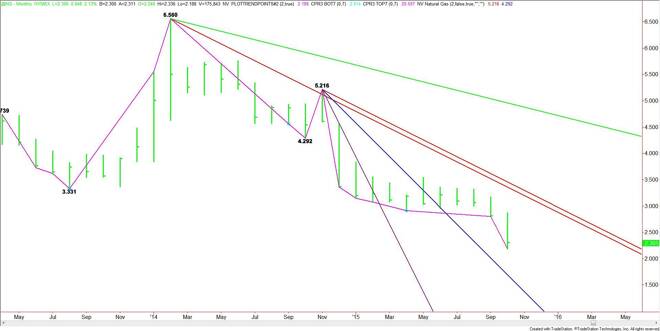

Nearby Natural Gas Monthly Technical Analysis for November 2015

By:

Let’s start by saying that the natural gas fundamentals are extremely bearish. Natural gas stocks are nearing 4 trillion cubic feet. Demand could be down

Let’s start by saying that the natural gas fundamentals are extremely bearish. Natural gas stocks are nearing 4 trillion cubic feet. Demand could be down in early November if unseasonably warm temperatures linger. Technically, the main trend is down according to the daily, weekly and monthly swing charts.

This being said, December Natural Gas futures could still rally in November because of technically oversold conditions and shifts in weather patterns throughout the month.

We’ll be going into the month with the market sitting at its lowest level since 2012. Currently, total natural gas storage sits at 3.877 trillion cubic feet. This is 409 billion cubic feet higher than last year at this time and 153 billion cubic feet above the five-year average of 3.724 trillion cubic feet for this time of year.

According to a recent report by the U.S. Energy Information Agency, supply is expected to peak at 3.956 this November, but some traders and analysts believe the total could top 4 trillion.

Everyone knows the fundamental story and can see the chart pattern. Therefore, your trading skill is going to make the difference this month. November’s price action is likely to be highlighted by a two-sided trade since the major players are likely to be trend and counter-trend traders.

You’ll have your trend traders who will be looking to press the market lower, or be waiting for rallies to sell. You’ll have your counter-trend traders who will be looking to take advantage of technically oversold conditions and the return to normal temperatures at times.

Counter-trend traders will be looking for seasonal buying opportunities while trend traders will be looking for fresh shorting opportunities due to the El Nino effect which could keep temperatures above average until March.

As a trader, this month you’ll have to be flexible enough to trade both sides. You’ll also have to take small losses if wrong especially if caught on the short-side because it looks like there is more room to run. The short side looks to offer limited downside opportunities if you sell weakness so bearish traders should be looking for rallies to sell.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement