Advertisement

Advertisement

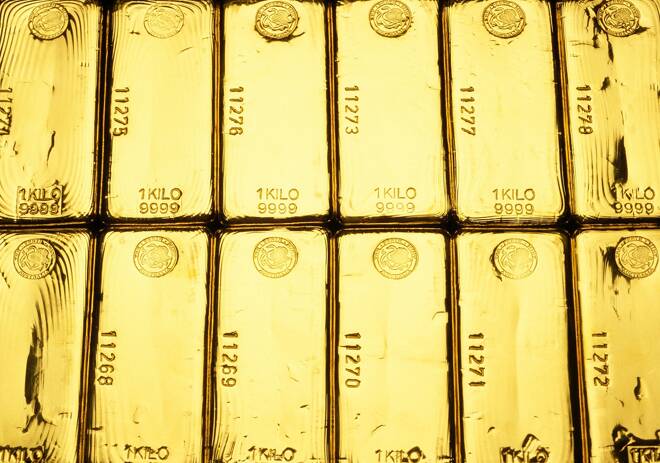

New Jobs Report Takes Dollar, Yields Higher and Gold Sharply Lower

By:

The strength of the jobs report coupled with the fact that a potential debt ceiling crisis had been averted made a recession less probable and add to the selling pressure created by market participants.

Gold and US Dollar Reaction to Employment Data

Gold prices fell sharply today after the BLS (Bureau of Labor Statistics) revealed that 339,000 new nonfarm payroll jobs were added last month, well above Wall Street estimates that predicted an increase in May of 190,000 new jobs. The report also showed that the unemployment rate rose from a 53-year low of 3.4% in April to 3.7% last month.

This created a strong bullish updraft in Treasury yields and the dollar resulting in a downdraft in dollar-priced bullion. However, it was selling pressure that was the strongest component in today’s price decline of both gold and silver. Spot gold lost $29.90 per ounce in trading today. This decline included -$20.80 the result of market participants actively selling, and -$9.10 the result of dollar strength according to the KGX (Kitco Gold Index).

The strength of the jobs report coupled with the fact that a potential debt ceiling crisis had been averted made a recession less probable and add to the selling pressure created by market participants. Gold futures declined by $31.20 or 1.56% taking the most active August 2023 Comex to $1964.30. The dollar gained 0.48% taking the index to 104. While gold and silver both had a strong daily decline both metals gained on the week.

Silver Today

Silver futures declined by 1.22% which is a loss of $0.29 per ounce taking the most active July contract to $23.695. Silver was also able to hold onto gains weekly. Silver futures opened at approximately $29.42 on Monday taking silver’s weekly gain just above $0.25. Silver’s decline was less than gold’s decline weekly. At least for today, selling pressure was muted when compared to gold due to a strong performance in US equities leading to higher demand for silver used in industry.

Job Report Implications on Future Rates and Recession Probability

Although today’s better-than-expected jobs report lowered the probability that the Federal Reserve will begin a rate hike pause this month, the probability of a pause is still remarkably high. The CME’s FedWatch tool predicts that there is a 73.6% probability of a rate hike pause down from 79.6% yesterday. The CME’s FedWatch tool estimated a 35.8% probability of a pause a week ago.

The caveat to today’s jobs report was in the estimates by Wall Street as May typically shows strong numbers in new jobs added as employers begin to higher seasonal summer jobs. The strong jobs report also lessened the probability of a recession down the road.

While the probability of an interest rate pause by the Federal Reserve at the June 14-15 FOMC meeting remains exceedingly high today’s jobs report increases the likelihood of a rate hike “Hop” in which the Federal Reserve pauses interest rate hikes this month but remains open to further hikes this year.

For those who would like more information simply use this link.

Wishing you as always good trading,

Gary S. Wagner

About the Author

Gary S.Wagnercontributor

Gary S. Wagner has been a technical market analyst for 35 years. A frequent contributor to STOCKS & COMMODITIES Magazine, he has also written for Futures Magazine as well as Barron’s. He is the executive producer of "The Gold Forecast," a daily video newsletter. He writes a daily column “Hawaii 6.0” for Kitco News

Advertisement