Advertisement

Advertisement

Quiet Before the Storm, Market Participants Brace for Powell’s Speech

By:

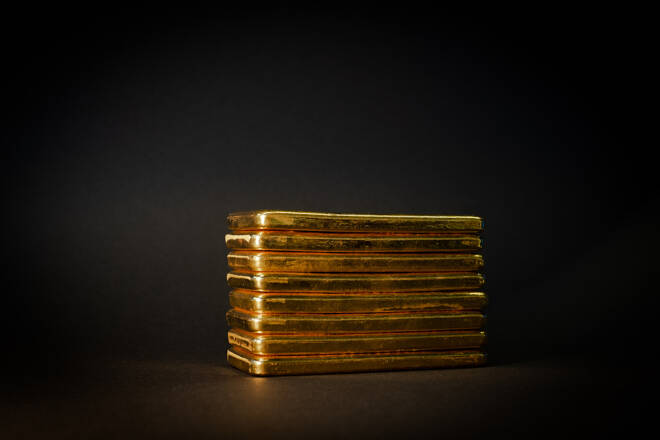

The expression calm or quiet before the storm is precisely what market participants witnessed today in gold futures.

Gold Futures Maintain Stability Following Previous Day’s Surge and Yield-Driven Rally

Gold futures are roughly at the same price they were yesterday after surging $20 higher. Compared to yesterday, the range from high to low in December gold futures contracted by half. Gold futures traded to a low of $1939.20, and a high of $1951.30 and is currently fixed at $1944.70 after factoring in today’s decline of $3.40. After four consecutive higher closes gold prices had a fractional price decline.

Yesterday’s tremendous upside move in both gold and silver was based on a sharp and decisive drop in yields of U.S. long-term treasuries. Yields on both 10-year notes and the 30-year bonds dropped by approximately 13 basis points yesterday. The decline in U.S. Treasury yields was due to the reaction of investors, traders, and market participants after learning about the latest PMI (Purchasing Managers Index) report out of Europe.

Anticipation Builds for Chairman Powell’s Speech at Jackson Hole Symposium

Today market participants for the most part remained inactive as they brace for tomorrow’s morning speech by Chairman Powell at the Federal Reserve’s annual Jackson Hole economic policy symposium began today and will conclude this Saturday. However, the pinnacle of this annual conference will occur when Chairman Jerome Powell takes the podium.

Market participants worldwide will be glued to his speech listening intently for any hint that they can glean about the future direction of the Fed’s monetary policy. A majority of analysts are under the assumption that the Fed will raise rates by ¼% one more time this year and that that assumption has been largely factored into current values.

Secondly, they will hope to gain clarity as to how long the Federal Reserve will maintain the current elevated rates and pivot to a monetary policy that involves rate cuts rather than rate hikes. There is still a tremendous amount of uncertainty about the future monetary policy of the Federal Reserve.

Gold Futures Hold Steady Despite Dollar Index Increase

The dollar index rose 0.68% to close at 103.93 and yet gold futures did not budge much from the gains achieved yesterday. With this in mind, gold faired rather well and buyers did come into the market today well aware of the volatility that might ensue following Powell’s speech at Jackson Hole.

For those who would like more information simply use this link.

Wishing you as always good trading,

Gary S. Wagner

About the Author

Gary S.Wagnercontributor

Gary S. Wagner has been a technical market analyst for 35 years. A frequent contributor to STOCKS & COMMODITIES Magazine, he has also written for Futures Magazine as well as Barron’s. He is the executive producer of "The Gold Forecast," a daily video newsletter. He writes a daily column “Hawaii 6.0” for Kitco News

Advertisement