Advertisement

Advertisement

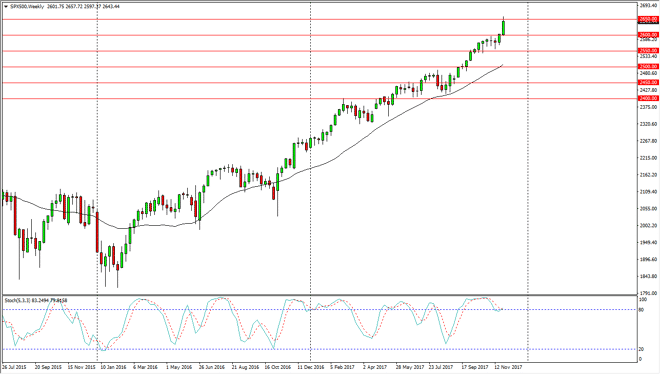

S&P 500 Index Price forecast for the week of December 4, 2017, Technical Analysis

Updated: Dec 3, 2017, 09:25 GMT+00:00

The S&P 500 has been explosive to the upside during the week, cranking above the 2650 level, but retreating during Friday’s messy session.

The S&P 500 has been very volatile over the week, initially being stronger than anticipated, but only finding Friday to be even worse, as General Flynn is set to testify against the White House and the Russian scandal. Longer-term, it’s likely that the market will continue to go to the upside, especially considering that towards the end of the day on Friday we saw more buying. Pullbacks at this point should find plenty of support at the 2600 level, which was previous resistance. If we broke above the 2650 level, the market should go higher than that as well. We have gotten a bit overextended though, and we are most certainly in the oversold section of the Stochastic Oscillator so that being said it’s likely that the market will eventually find some reasonable back. Those pullbacks should be thought of as buying opportunities in a market that has plenty of reason to go higher.

S&P 500 Video 04.12.17

The markets continue to be noisy, and we have not had a significant amount of a pullback recently, and that means that the market should do so. We have not had a reasonable pullback like you see in a healthy uptrend, so, therefore, I’m afraid that once we do finally get a pullback, the market should pull back very quickly. Ultimately, the market looks very likely to see the buyers get involved when they can, and algorithmic trading, of course, continues to keep the market afloat. The market pulling back a nice 5% would be an excellent longer-term investment. Until then, it’s just a quick short-term buying opportunity on the set knee-jerk reactions to the downside.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement