Advertisement

Advertisement

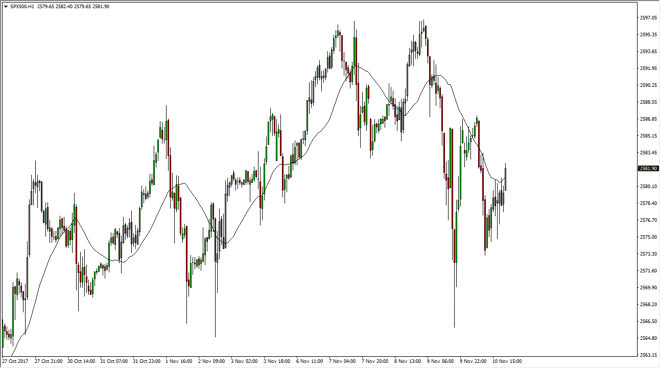

S&P 500 Price Forecast November 13, 2017

Updated: Nov 12, 2017, 10:22 GMT+00:00

S&P 500 The S&P 500 broke down rather significantly during the trading session on Friday but found enough support near the 2573 level to turn

S&P 500

The S&P 500 broke down rather significantly during the trading session on Friday but found enough support near the 2573 level to turn around and rally a bit. However, I am a bit hesitant to get long of this market now, because I believe there is more than enough reason to think that we are at the very least overextended, if not right for a major pullback. Ultimately, I think that the geopolitical concerns around the world could ratchet up, and if that’s the case, it should be negative for stock markets. I believe that the 2600 level above will continue to be a ceiling in this market for the short term, so I’m looking to sell rallies for short-term trades at best. Over I believe that longer-term traders will be looking at these pullbacks as value plays.

S&P 500 Video 13.11.17

I think that although the earnings season has been reasonably decent for the last couple of weeks, quite frankly I think we are just simply far too bullish. I think that the market has come too far into short of a timeframe, and therefore think it’s only a matter of time before we must pull back significantly. Saudi Arabia beating the war drums, North Korean issues, the U.S. Congress not been able to get tax reform through, there are too many areas around the world that suggests that we could get a bit of a long-needed pull back. Because of this, I think that we are in a very precarious situation, and therefore could see a scenario in which it’s best to sit on the sidelines, but right now I think that selling exhaustive candles on short-term charts for small moves is probably the easiest trade to take. If we did break above the 2600 level, that could be a sign that we are ready to extend the already overbought conditions.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement