Advertisement

Advertisement

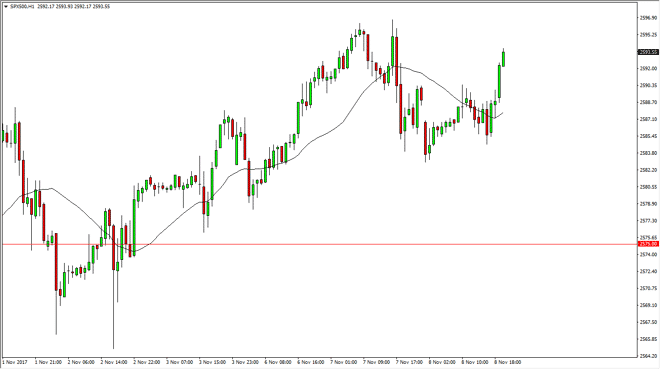

S&P 500 Price Forecast November 9, 2017, Technical Analysis

Updated: Nov 9, 2017, 08:18 GMT+00:00

The S&P 500 rallied during the day on Wednesday, reaching towards the 2600 level yet again. I believe this area will continue to offer extreme

The S&P 500 rallied during the day on Wednesday, reaching towards the 2600 level yet again. I believe this area will continue to offer extreme resistance, so it’s likely that we may have to pull back to build up the momentum to break out to the upside. If we can break above the 2600 level, I think the next target is probably the 2700 level above. I think pullbacks at this point should be buying opportunities, as the 2575 level has offered support. Longer-term, the market should continue to be a situation where buyers come in on dips, based on the idea of value. I think that the market should continue to be very volatile, and of course, you should keep in mind that longer-term it is likely a bit overbought. However, given enough time, the buyers tend to return. There are decent returns on the earnings season announcement, and I think it should continue to be the main driver to the upside.

S&P 500 Video 09.11.17

Longer-term, I believe that the 2500 level is a “floor” in the market. I think that if we can stay above there, the long-term is most certainly favoring the upside, and then offer value on these dips. I like the idea of picking up value as it appears, and I believe that eventually, we will continue the next leg higher, but I also recognize that there is a lot of overhangs currently, and I believe the pullbacks are more than likely going to give people who have missed out on the rally an opportunity to get involved. If we were to break down below the 2500 level, that would be a very negative sign and could change the overall trend of the market. However, I think that’s very unlikely to happen.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement