Advertisement

Advertisement

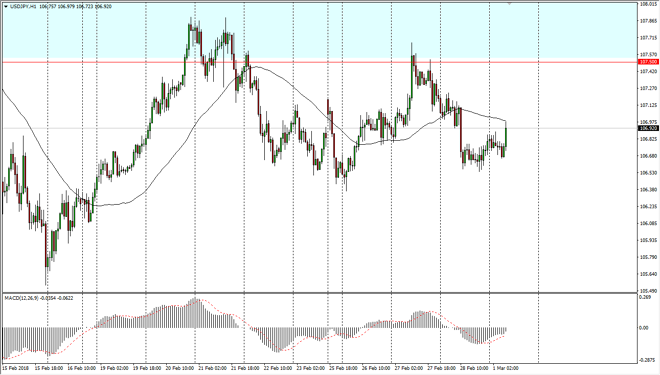

USD/JPY Price Forecast March 2, 2018, Technical Analysis

Updated: Mar 2, 2018, 05:35 GMT+00:00

The US dollar has initially dipped during the trading on Thursday, but then reached higher to test the 107 level as I record this. It looks likely that this market has found support enough to turn things around, least in the short term.

The US dollar has initially pulled back during the trading session on Thursday, reaching towards the 106.50 level, before bouncing towards the 107 handle. Ultimately, the market looks likely will reach towards the 107.50 level, and then perhaps the 108 level. The market looks to be very noisy, but I believe that the 106.50 level underneath will continue to offer a bit of support. I think that we are going to continue to find buyers, especially if the stock markets start to pick up again. I think that the market should then go to the 110 level, and then perhaps the 114 level after that.

I think there is a massive amount of support near the 105 level, an area that has been important both psychologically and structurally in the past, so a breakdown below that level would be catastrophic for this pair, almost certainly guarantee a move down to the 100 level. Longer-term, I believe that the market should continue to find plenty of reasons to go higher, especially if interest rates in America continue to rise, as the interest rate differential between the 10-year notes of both countries will more than likely drive where we go next. I think that given enough time, we will see much higher pricing, but this is more of a longer-term target than anything else. I believe that the market will continue to be noisy, but pullbacks continue to offer value that plenty of people are willing to pick up when offered.

USD/JPY Video 02.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement