Advertisement

Advertisement

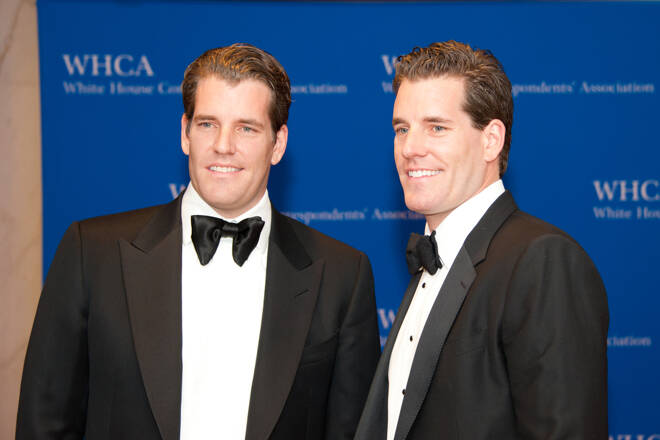

Winklevoss Twins Endeavor to Make Bitcoin More Sustainable

By:

Tyler and Cameron Winklevoss via Gemini are buying carbon credits to lessen bitcoin's carbon footprint.

The trajectory of the bitcoin price this year started to take a sharp turn in the wake of criticism from billionaire entrepreneur Elon Musk. Now another set of billionaires — Tyler and Cameron Winklevoss — are doing their part to shift the narrative. Musk shined a spotlight on bitcoin’s carbon footprint back in May and the price has been on a downward trajectory ever since.

Carbon Credit Push

The Winklevoss twins through the cryptocurrency exchange they founded, Gemini, have reportedly acquired USD 4 million in carbon credits as a way to counterbalance the bitcoin held in custody at the exchange, according to a report on Bloomberg. They’ve chosen a Delaware-based non-profit organization called Climate Vault to move closer to “net zero” with the bitcoin held on Gemini.

When Elon realizes that bitcoin mining is actually pushing the renewable energy industry forward, he will refresh position and #bitcoin will moon.

— Cameron Winklevoss (@cameron) May 13, 2021

On average in 2021, the exchange has held more than USD 8 billion in BTC on its platform, or close to 251,000 bitcoins, across its hot wallets for trades and cold wallets for storage. They will continue to make this carbon offset push until bitcoin mining only uses renewable energy sources to secure the blockchain. So it is safe to assume that there will be more buying of carbon credits.

Tyler Winklevoss told Bloomberg,

“We want to build a better world. It’s also important to be sustainable as we navigate into that vision.”

FWIW, Bitcoin mining is a massive subsidy for renewable energy

— Tyler Winklevoss (@tyler) May 13, 2021

JPMorgan’s Bitcoin Price Target

As the cryptocurrency community grapples with the price dynamic in the market, JPMorgan has added fuel to the fire. Analysts at the bank have published what they believe is a fair price for the flagship cryptocurrency, which is currently trading at USD 33,872 and has seen a peak of more than USD 63K this year.

JPMorgan uses a formula comparing bitcoin’s volatility to that of gold, considering they are both rival store-of-value assets. In this case, bitcoin’s “theoretical price target” is USD 140K, based on the “convergence” of that volatility and the “equalization” of investors’ gold and bitcoin holdings.

They go on that considering bitcoin’s volatility is on track to be six times that of the precious metal, its price target gets knocked down to USD 23K on a fair value basis. If bitcoin’s volatility abates to just four times that of gold by the end of 2021, its fair value jumps up to USD 35K.

Ramp Capital makes a pretty good assessment of Wall Street’s attempt to gain a grip on the bitcoin price coupled with the market’s volatility:

[Analyst at 8 a.m.]

With the recent selloff in Bitcoin we are lowering our fair value price to $25,000.

[Analyst at noon]

With the recent rise in Bitcoin we are raising our fair value price to $250,000.

— Ramp Capital (@RampCapitalLLC) May 19, 2021

About the Author

Gerelyn Terzoauthor

Gerelyn is a cryptocurrency and blockchain journalist who has been engaged in the space since mid-2017 when bitcoin was embarking on its first major bull run

Advertisement