Advertisement

Advertisement

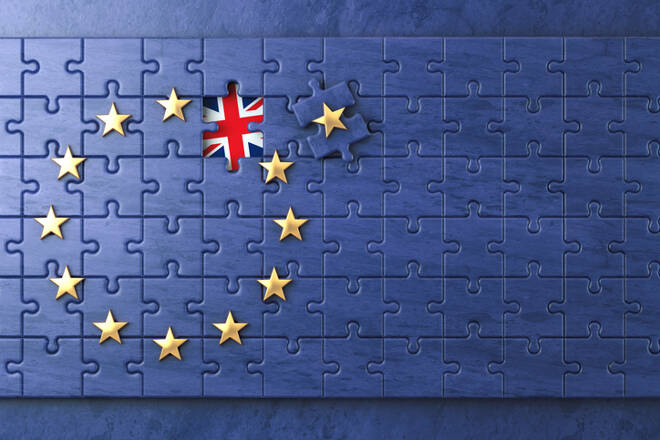

Brexit and the ECB’s Minutes Put the GBP and the EUR in Focus

By:

With a light economic calendar for the day ahead, Brexit debate and the ECB monetary policy meeting minutes will be in focus.

Earlier in the Day:

Economic data released through the Asian session this morning was on the lighter side, with stats limited to December retail sales figures out of the UK and December inflation figures out of China.

Out of the UK, the BRC Retail Sales Monitor fell by 0.7% in December, year-on-year, which was worse than a forecasted 0.3% decline, following November’s 0.5% fall.

- With like for like sales falling by 0.7%, the total 3-month average sales for all categories rose by 0.5%.

- The total 3-month average for food rose by 1.8%, while the total 3-month average for non-food sales fell by 0.4%.

- Total sales growth stalled for the first time in 28-months in December to deliver the worst December sales performance in 10-years.

The Pound moved from $1.27982 to $1.27969 upon release of the figures in the early part of the day, the markets brushing aside the numbers as focus remained on Brexit.

Out of China, inflation numbers came in soft, with the annual rate of inflation easing from 2.2% to 1.9%, which was worse than a forecasted 2.1%.

- Month-on-month, consumer prices stalled, coming in short of a forecasted 0.3% rise following November’s 0.3% fall.

- Wholesale price inflation also eased from a November 2.7% to 0.9%, the slowest since Sept-16, coming up well short of a forecasted 1.6% rise in wholesale prices, year-on-year.

The Aussie Dollar moved from $0.7156 to $0.71553 upon release of the figures before moving to $0.7156 at the time of writing, a loss of 0.20% for the session.

Elsewhere, the Japanese Yen was up 0.23% to ¥107.92 against the U.S Dollar, with the Kiwi Dollar down 0.22% to $0.6773, risk appetite hitting reverse through the session.

In the equity markets, it was “risk-off” with the Nikkei sliding by 1.34% early on in the day, weighed by the risk off sentiment and bounce in the Yen. The Hang Seng and ASX200 saw more modest losses, the pair down by 0.32% and by 0.18% respectively, while the CSI300 managed to move into positive territory, up by 0.02% at the time of writing, the index finding support from progress on trade talks, though there’s ultimately a long way to go before any resolution that will keep the markets on tender hooks for some time yet.

The U.S future were also in the red early on in the day, with the Dow Mini down 117 points, the real question being whether the U.S and China and can achieve the agreements made during the 3 days of talks.

The Day Ahead:

For the EUR, there are no material stats scheduled for release through the day, leaving the EUR in the hands of market risk sentiment and sentiment towards monetary policy and the economic outlook, the economic outlook certainly looking gloomy should there not be a marked turnaround in December figures.

With no material stats due out, the ECB’s monetary policy meeting minutes are due out in the early afternoon, which could provide some direction for the EUR should there be any discussions on a shift in policy towards interest and deposit rates through the first quarter of this year.

Expectations are for the minutes to reflect the dovish tones from the last ECB press conference, with easing inflationary pressures and downward revisions to growth forecasts likely to keep the ECB pinned back from a policy shift on rates near-term.

At the time of writing, the EUR was up 0.06% to $1.150, with today’s minutes and market risk sentiment to provide direction through the day.

For the Pound, it’s another quiet day on the economic calendar, with no material stats scheduled for release following the retail sales figures released during the Asian session.

Focus remains on Brexit and, with plenty of rebels within the Tory ranks, Theresa May’s position at the top is looking ever more precarious as each vote sees the British PM’s power ebb away. Ironically it’s been a positive for the Pound, with parliament looking to take control of Brexit should Britain’s deal be deemed unacceptable.

At the time of writing, the Pound was down by 0.09% to $1.2778, with updates from parliament the key driver through the day.

Across the Pond, economic data is on the lighter side, with key stats limited to November trade figures and the weekly jobless claims numbers.

Outside of the numbers, FED Chair Jerome Powell is scheduled to speak late in the day, recently more cautious tones expected to continue following the softer ISM non-manufacturing PMI numbers at the start of the week.

With U.S – China trade talks concluded, updates on trade talks and the U.S administration and China’s next moves will be in focus near-term along with any updates over the extended government shutdown that could become the longest shutdown in history should there be no resolution over the weekend.

At the time of writing, the Dollar Spot Index was down 0.06% to 95.163.

For the Loonie, economic data scheduled for release is limited to November building permits and new house price index numbers that will likely have a relatively muted impact on the Loonie, with the Loonie likely to find direction from crude oil prices.

The Loonie was down 0.22% to C$1.3238 against the U.S Dollar at the time of writing, falling crude oil prices weighing early on in the day.

About the Author

Bob Masonauthor

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Advertisement