Advertisement

Advertisement

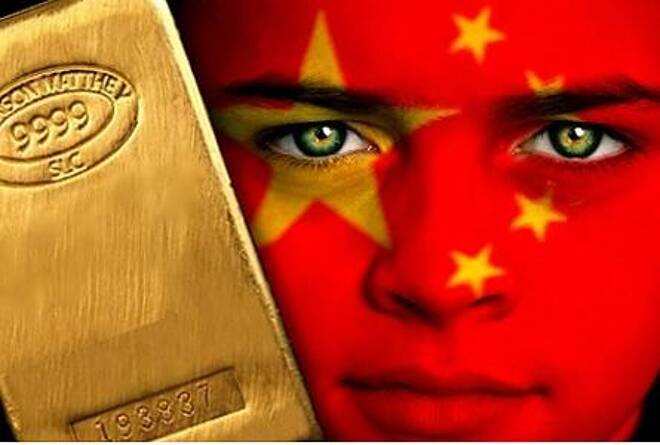

China Enters The Gold Markets And Sets Daily Fix

By:

Gold gave back oil inspired gains this morning to trade at 1231.90 down $3.10 in the Asian session. Silver dipped 43 points but remains well above its

Gold gave back oil inspired gains this morning to trade at 1231.90 down $3.10 in the Asian session. Silver dipped 43 points but remains well above its average trading range, outperforming the yellow metal. Platinum ignored the markets and gained $1.65 to 981.60. Gold prices rose on Monday after oil producers failed to agree on an output freeze, sending crude prices and equities tumbling and stocking safe-haven demand for bullion.

A deal to freeze oil output by OPEC and non-OPEC producers fell apart on Sunday after Saudi Arabia demanded that Iran join in despite calls on Riyadh to save the agreement and help prop up crude prices. Gold had gained early on Monday after oil prices and Asian equities slid in the wake of oil producers’ failure to agree on a plan to curb output, but ended the day lower as crude recovered.

With the Federal Reserve meeting on the calendar next week, gold will be responsive to Fed comments and traders will try to hedge their expectations. Dovish comment from a U.S. Federal Reserve official did not help gold per Reuters. The Fed is set to hike interest rates more rapidly than investors currently expect, Boston Fed President Eric Rosengren said on Monday, again pushing back on what he said was investors’ too pessimistic view of the U.S. economy and monetary policy. But New York Fed President William Dudley said U.S. economic conditions are “mostly favorable” yet the Fed remains cautious in raising interest rates because threats loom.

Oil prices edged up in early trading on Tuesday as an oil worker strike in Kuwait cut huge amounts of crude out of the supply chain. But analysts warned that the disruption would be short-lived and that markets would soon refocus on a global supply glut following the failure on Sunday by major exporters to rein in oversupply.

China.org announced that China will launch a new contract today to set a “benchmark” price for gold bullion in the world’s biggest producer and consumer of gold, as part of efforts to increase its influence in pricing of the precious metal.

The yuan-denominated gold fix will be launched on the Shanghai Gold Exchange this morning, with the benchmark price at 257.97 yuan per gram, said a statement released by the exchange yesterday.

Eighteen banks and bullion traders have been chosen as initial market makers for the fix, including 10 Chinese lenders, Standard Chartered Bank, Australia and New Zealand Banking Group and six domestic and international bullion traders including Switzerland-based MKS Gold Ltd, the exchange said.

The world’s top producer and consumer of gold has long been pushing to be a price-setter for bullion to enhance its influence on Asian and global markets.

The strategic move, coming a decade after China started to reform the gold market, of setting a new gold fix price also supports the internationalization of the yuan, an industry analyst from one of auction participants told Shanghai Daily yesterday. It will add pressure on the century-old London gold fix price.

China, which resumed its regularly reporting of bullion buying in July after a six-year gap, bought an impressive 103.9 tons in the second half of 2015, according to World Gold Council. China’s gold reserves have ballooned by 708.2 tons since April 2009, the council added.

About the Author

Barry Normanauthor

Advertisement