Advertisement

Advertisement

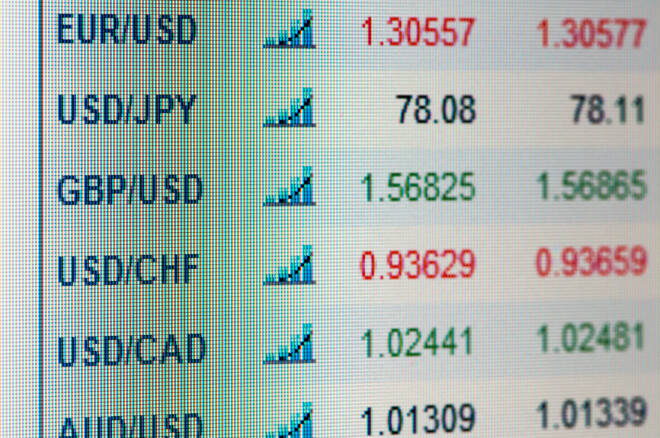

Economic Data Puts the EUR and the Dollar in the Spotlight, with U.S Politics also in Focus

By:

It's a busy day ahead, with economic data, U.S politics, COVID-19, and Brexit to provide direction throughout the day.

Earlier in the Day:

It’s was a busy start to the day on the economic calendar this morning. The Aussie Dollar and the Japanese Yen were in action in the early part of the day.

Away from the economic calendar, U.S politics and COVID-19 continued to be the main area of focus.

For the Japanese Yen

Inflation and industrial production figures were in focus this morning.

In October, Tokyo consumer prices fell by 0.5%, year-on-year, following a 0.2% decline in September. Economists had forecast a 0.5% fall.

According to the Ministry of Internal Affairs and Communication,

- Falling prices for culture & recreation (-4.4%). Fuel, light, & water charges (-3.4%), and education (-1.8%) weighed in October.

- There were increases in prices for clothes & footwear (+1.6%), furniture & household utensils (+1.5%), and housing (+0.4%), however.

The Japanese Yen moved from ¥104.577 to ¥104.559 upon release of the figures that preceded prelim industrial production figures.

According to the Ministry of Economy, Trade, and Industry, industrial production jumped by 4% in September.

Industries that mainly contributed to the increase were:

- Motor vehicles, production machinery, and electrical machinery, and information, and communication electronics equipment.

Industries that mainly contributed to the decrease were:

- General-purpose and business-oriented machinery and inorganic and organic chemicals.

Industrial forecasts for October 2020 were revised up from a 2.9% increase in production to a 4.5% rise. For November 2020, industrial production was forecasted to increase by 1.2%.

The Japanese Yen moved from ¥104.541 to ¥104.534 upon release of the figures. At the time of writing, the Japanese Yen was up by 0.02% ¥104.59 against the U.S Dollar.

For the Aussie Dollar

Wholesale inflation figures for the 3rd quarter and September private sector credit numbers were in focus.

Quarter-on-quarter, the producer price index increased by 0.4%, partially reversing a 1.2% slide from the 2nd quarter. Year-on-year, however, producer prices fell by a further 0.4%, following on from a 0.4% decline in the 2nd quarter.

Private sector credit increased by 0.1% in September, reversing a 0.1% decline from August.

The Aussie Dollar moved from $0.70294 to $0.70326 upon release of the figures. At the time of writing, the Aussie Dollar was up by 0.06% to $0.7033.

Elsewhere

At the time of writing, the Kiwi Dollar was down by 0.09% to $0.6623.

The Day Ahead:

For the EUR

It’s a particularly busy day ahead on the economic calendar.

Key stats include 3rd quarter GDP numbers for the Eurozone, France, Germany, and Spain and retail sales figures for France and Germany.

Prelim October inflation figures for France, Italy, and the Eurozone and Eurozone unemployment figures are also due out.

While the stats will influence, market concern over the economic outlook towards the 4th quarter would limit the impact of any positive numbers.

Any pickup in deflationary pressures amidst the negative sentiment would also be EUR negative.

Away from the economic calendar, expect U.S politics and COVID-19 to continue to influence.

At the time of writing, the EUR was flat at $1.1674.

For the Pound

It’s yet another quiet day ahead on the economic calendar, with no material stats to provide the Pound with direction.

The lack of stats leaves the Pound squarely in the hands of Brexit chatter, COVID-19, and market risk sentiment.

With the BoE monetary policy decision next week, updates from Brexit talks could be key to the BoE’s next move. Lockdown measures amidst the 2nd wave of the COVID-19 pandemic should support a more dovish stance, however.

At the time of writing, the Pound was down by 0.04% to $1.2925.

Across the Pond

It’s a relatively busy day ahead for the U.S Dollar.

Key stats personal spending, inflation, and Chicago PMI numbers. Finalized consumer sentiment figures for October are also due out.

Barring particularly dire numbers, however, the stats are unlikely to have an impact on the Dollar and market risk sentiment.

With the U.S Presidential Election and Senate Election days away, the polls will draw plenty of interest.

COVID-19 and concerns over the economic outlook will also play a part in the day.

At the time of writing, the Dollar Spot Index was down by 0.02% to 93.920.

For the Loonie

It’s a relatively busy day on the economic data front, with key stats including August GDP and September RMPI numbers.

Expect the GDP figures to have the greatest influence on the day.

Away from the economic calendar, however, concerns over the impact of the COVID-19 pandemic on the global economic recovery will remain the key driver.

At the time of writing, the Loonie was up by 0.10% to C$1.3312 against the U.S Dollar.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Bob Masonauthor

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Advertisement