Advertisement

Advertisement

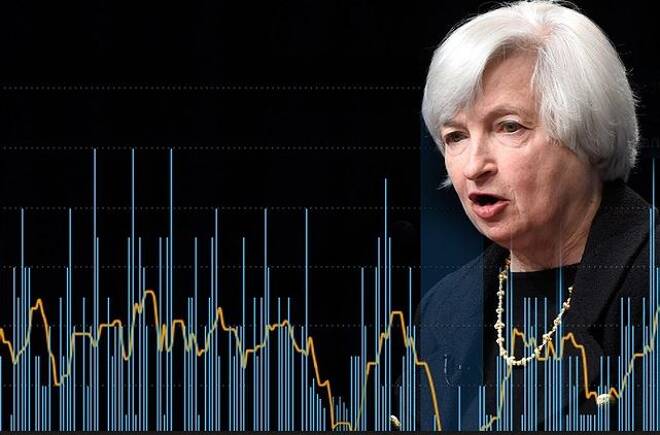

Fed Minutes Triggers Violent Response by Stock Investors

By:

The U.S. Federal Reserve generated a violent reaction in the financial markets Wednesday afternoon when the minutes from its Federal Open Market Committee

The U.S. Federal Reserve generated a violent reaction in the financial markets Wednesday afternoon when the minutes from its Federal Open Market Committee meeting on March 15 showed the central bank wanted to start unwinding its massive $4.5 trillion balance sheet later this year.

The minutes also showed “some participants viewed equity prices as quite high relative to standard valuation measures.”

U.S. Equity Markets

U.S. stocks finished lower on Wednesday after posting a dramatic late-afternoon reversal following the release of the Fed minutes. In one of its heaviest volume days of the year, the blue chip Dow Jones Industrial Average finished down 41.09, or 0.20 percent at 20648.15. The benchmark S&P 500 Index ended the session down 7.21, or 0.31 percent, to 2352.95 and the tech-based NASDAQ Composite lost 34.13 points, or 0.58 percent, to 5864.48.

The highlight of the trading session was the massive intraday reversal by the Dow, its largest in 14 months. From its high, it shed more than 198 points to end near the session low.

Investors were also spooked by worries about the Trump administration’s ability to deliver promised tax reform. Concerns increased after comments from lawmakers about the deep divisions in Washington. U.S. House of Representatives Speaker Paul Ryan probably contributed to the selling pressure after he said tax reform will take longer to accomplish than healthcare.

Economic News

Early in the session, a report from ADP said private payrolls rose by 263,000 last month, well above the consensus estimate of 185,000. The February figure was revised significantly lower, however, from the originally reported 298,000.

Other data released Wednesday the Institute for Supply Management non-manufacturing index came in at 55.2, below an expected read of 57.

U.S. Treasurys

The volatility in the equity markets sent investors into the safety of the Treasury markets. This helped drive the U.S. 10-year Note yield lower. It finished near 2.333 percent, after hitting 2.38 percent earlier in the session.

Forex

The U.S. Dollar initially spiked higher in reaction to the Fed minutes. This is because the action suggested by the Fed is essentially a rate hike. After the initial thrust failed to gain traction, the June U.S. Dollar Index broke sharply from its high to finish only slightly better.

Gold

June Comex Gold broke sharply from a one-month high hit on Tuesday after better-than-expected U.S. jobs data boosted U.S. Treasury Bond yields, supporting the U.S. Dollar and making the dollar-denominated gold market a less desirable investment.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement