Advertisement

Advertisement

How Country of Regulation is Connected with Your Broker’s Competitiveness?

Updated: Mar 4, 2019, 13:25 GMT+00:00

Does regulation make a difference in your broker’s general competitiveness or a good regulation comes into play only when it comes to deposit protection

Does regulation make a difference in your broker’s general competitiveness or a good regulation comes into play only when it comes to deposit protection and client complaint management?

Experienced forex traders know it well how important a good regulation can be. You can expect higher level of investor protection, a fair process to address your complaints, an unbiased and professional regulatory body to turn to if your broker fails to live up to your expectations; and in general, you can expect that more sophisticated regulatory audits will improve your broker’s operations, compliance and decrease the risk that something really bad would happen.

But if there’s something that regulation itself does not influence it’s your broker’s spread. In theory.

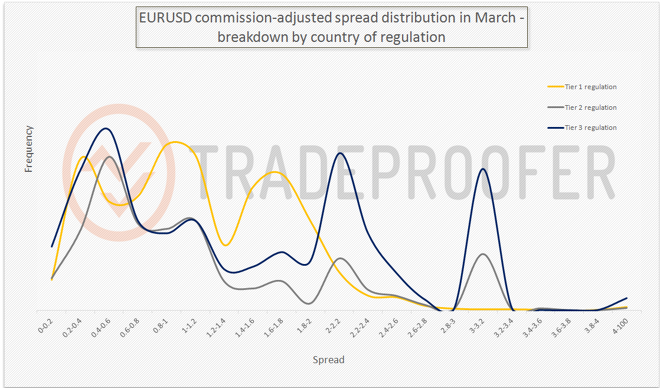

We made a little experience with the March broker spread data we got and picked EURUSD. We classified the 100+ brokers covered by the TradeProofer community into 3 leagues:

Tier1 – first class regulation countries (UK, US, Australia, Germany, Japan etc.)

Tier2 – other respected regulations (most EU countries, Singapore, New Zealand, etc.)

Tier3 – remote islands, bankrupt countries and other funny places (you can imagine)

We also adjusted the raw spreads with commissions just to make spreads comparable. Commission adjustment was done presuming a plain USD trading account with no commission discount due to trading volume or high deposit. Refering back to the earlier statement, theoretically, we shouldn’t see significant difference between regulations, but apparently, there is.

As you see on the chart, brokers from Tier1 countries are more likely to dwell in the more competitive 0.2-2 pips segment.

Brokers regulated in Tier2 countries show a more even distribution over the whole range with some modest spikes around the “roundy” 2, 3 pips.

Brokers from Tier3 countries show the most interesting characteristics: they have 3 main spikes: one in the most competitive 0.2-0.6 “battlefield”, the other two are around the the least competitive corner around 2 and 3, the regular meetingpoint of fixed-spread brokers.

We were rather surprised at TradeProofer. Before the analysis, our best guess was regulation did not make a difference and if it did, a more expensive Tier1 regulation would come at a price and therefore brokers from Tier1 countries would have slightly less competitive spreads when compared with brokers from Tier3 countries who might not even spend a cent on a compliance officer or bother themselves about FCA standards.

This is a guest post written by Viktor Eperjesy, a content and data specialist from TradeProofer

About the Author

Advertisement