Advertisement

Advertisement

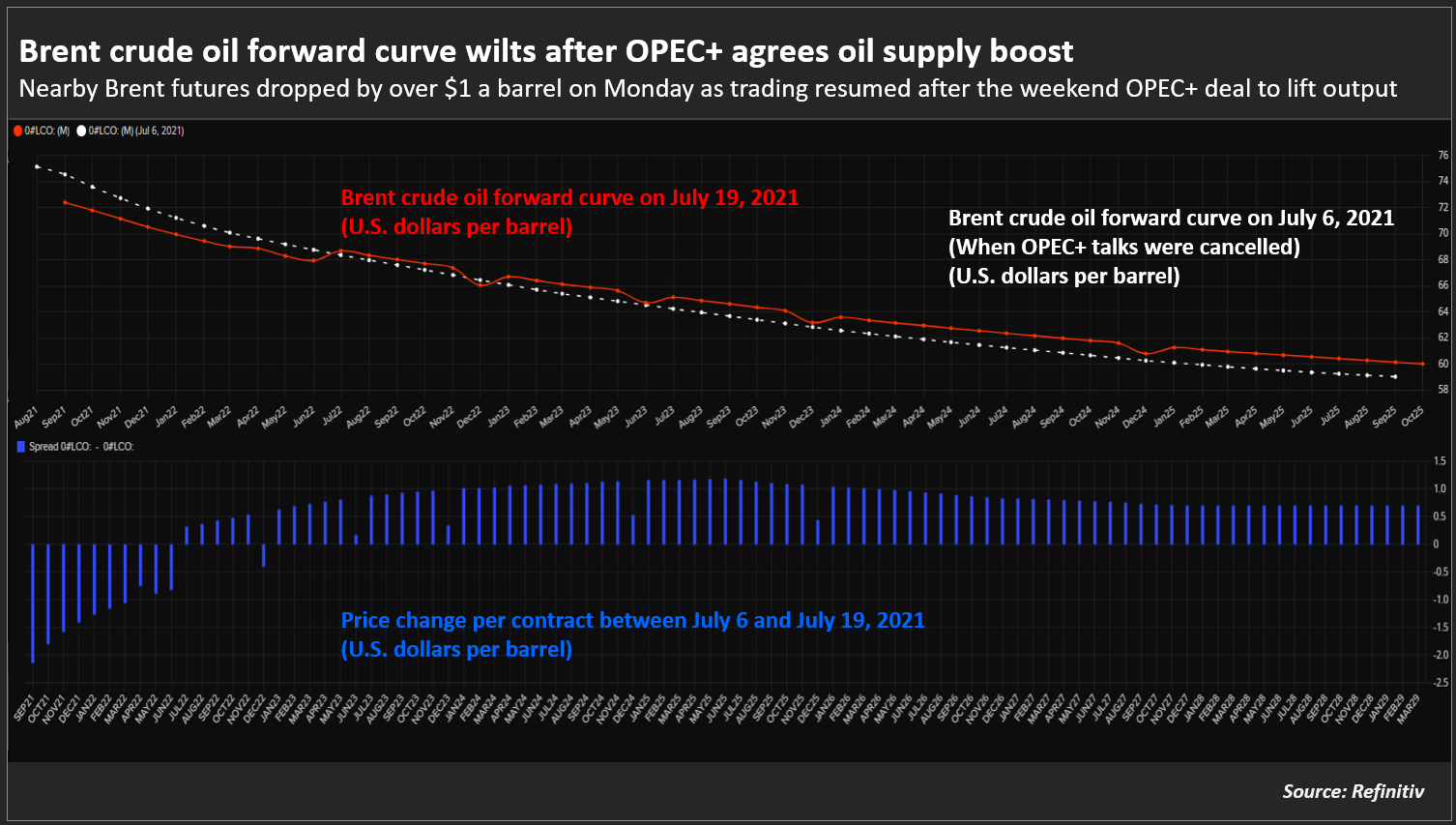

Oil Falls 5% After OPEC+ Producers Agree to Raise Output

By:

TOKYO (Reuters) -Oil prices recouped some losses on Monday, but were still down after OPEC+ overcame internal divisions and agreed to boost output, which sparked concerns about a crude surplus as COVID-19 infections continue to rise in many countries.

By Noah Browning

LONDON (Reuters) – Oil prices fell over $3 in their largest daily decline since late March on Monday after OPEC+ overcame internal divisions and agreed to boost output, causing concern about a crude surplus as COVID-19 infections rise in many countries.

Brent crude was down $3.61, or 4.9%, at $69.68 a barrel by 1405 GMT. U.S. oil was down $3.75, or 5.2%, at $68.06 a barrel.

OPEC+ ministers agreed on Sunday to increase oil supply from August to cool prices that this month hit their highest level in more than two years as the global economy recovers from the COVID-19 pandemic.

The group of members of the Organization of the Petroleum Exporting Countries (OPEC) and allies such as Russia also agreed new production shares from May 2022.

“Longer-term, free and additional production capacities from OPEC+ countries are the key reason why we see oil moving lower again,” said Julius Baer analyst Carsten Menke.

“We remain confident that the oil market is in the final phase of its upcycle.”

Goldman Sachs, however, said it remained bullish on the outlook for oil and the agreement was in line with its view that producers “should focus on maintaining a tight physical market all the while guiding for higher future capacity and disincentivising competing investments.”

But PVM Oil analyst Tamas Varga sounded a note of caution on the pace of the expected recovery of demand from the pandemic.

“The global COVID situation is turning dire again and it understandably makes investors wary although it must be stressed that restrictions are being eased in other parts of the world.”

OPEC+ last year cut output by a record 10 million barrels per day (bpd) as the pandemic hollowed out demand, prompting a collapse in prices with U.S. oil futures prices at one point falling into negative territory.

OPEC+ producers have gradually eased their output curbs, which now stand at around 5.8 million bpd.

To overcome internal divisions, OPEC+ agreed new production quotas for several members from May 2022, including the UAE, Saudi Arabia, Russia, Kuwait and Iraq.

(Editing by Jacqueline Wong, Jason Neely and Angus MacSwan)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Advertisement