Advertisement

Advertisement

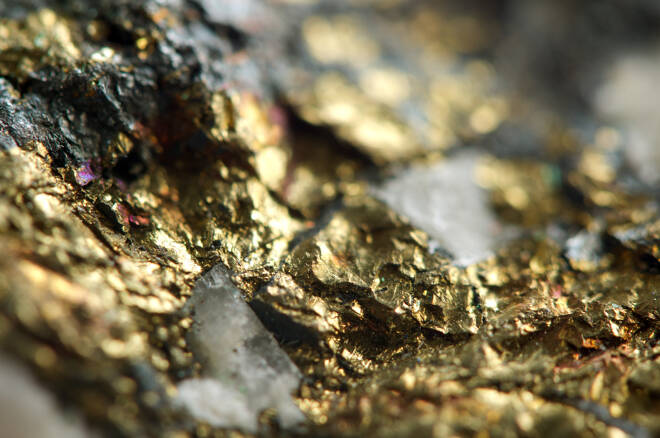

Precious Metals Continue to Gain Ahead of US FOMC Update

By:

As USD Remains weak in global market ahead of FOMC update, precious metals trade positive supported by influx of fund from emerging markets.

Precious metals today saw positive price action in spot and futures market second consecutive session. The global equity market is seeing mixed price action while the forex market is seeing rangebound price action as investors have taken a cautious stance and held back from placing major bets ahead of key events scheduled to occur this week. US Dollar is trading weaker in the global market as investors expect US Federal Reserve to take a dovish stance owing to recent disappointing US macro data with a chance for forward guidance hinting at a rate cut later this year. Precious metals denominated in US Greenback gain momentum in the broad market when USD weakens in the broad market.

OPEC Supply Reduction Enforcement Provides Fundamental Support To Crude Oil Bulls

A lower value of USD in the broad market would mean a lower exchange rate for investors who hold other currencies making it a good time to invest in precious metals. Further, recent headlines suggest that geopolitical issues don’t seem like they will be resolved anytime soon which also underpins demand for safe-haven assets as investors turn to safe-haven assets for protection against volatility influenced by mishaps in geopolitical events. The key events in the week ahead are US FOMC update, EU vote on Brexit deadline extension both of which could have considerable influence on the directional bias of high-risk assets.

As of writing this article, spot gold XAUUSD is trading at $1309.25 per ounce up by 0.43% on the day while US Gold Futures GCcv1 is trading at $1309.90 per ounce up by 0.64% on the day. Meanwhile, spot silver XAGUSD is trading at $15.40 per ounce up by 0.38% on the day. Crude oil price scaled new 2019 highs today in both spot and futures markets. However, profit booking activities resulted in futures seeing price decline from intra-day highs while spot market saw price hold steady near intra-day highs. While there hasnt been any new major update surrounding Crude oil market Russia is expected to meet full compliance with OPEC’s production cut plans and disruption from Venezuelan supply added to widening demand to supply ratio with each passing day. This factor continues to help crude oil price climb slowly in the global market. Spot US Crude oil WTIUSD is trading at $59.37 per barrel up by 0.54% on the day.

About the Author

Colin Firstauthor

Colin specializes in developing trading strategies and analyze financial instruments both technically and fundamentally. Colin holds a Bachelor of Engineering From Milwaukee University.

Advertisement