Advertisement

Advertisement

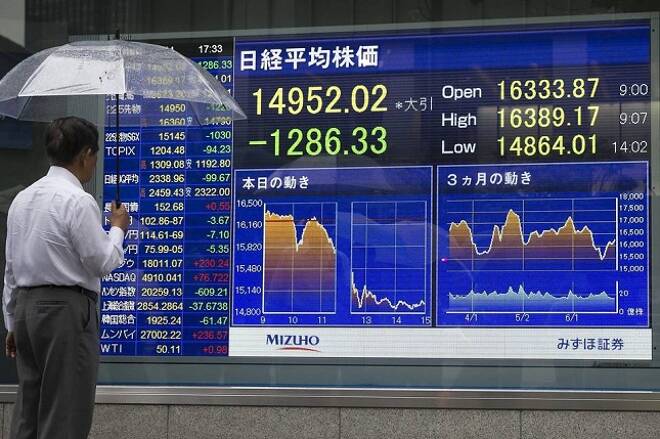

Risk Appetite Increases as Yen Dips Following Softer Japanese GDP

By:

European stock markets are moving higher, as the risk on trade hits global stocks as the yen weakened following softer than expected Japanese GDP. The

European stock markets are moving higher, as the risk on trade hits global stocks as the yen weakened following softer than expected Japanese GDP. The FTSE 100 is underperforming and little change on the day as Sterling moves higher. The Euro Stoxx 50 is up, with the DAX leading the way and up more than 0.5%. Miners were supported by a rise in iron-ore and copper prices, which helped the markets in Asia remain buoyed. Oil prices have retraced despite comments from the Kuwait oil minister about OPEC compliance.

The yen moved lower following a softer than expected Japanese GDP report for the Q4 which showed that growth slowed in the world’s 3rd largest economy to 1% compared to expectations of a 1.4% forecast.

German Wants to Complete Greek Program with IMF

In Europe, the focus remains on Greece. It appears that Germany wants to complete Greek program with IMF. German foreign ministry spokesman Schaefer confirmed that Germany’s goal still is to complete the Greek bailout program with IMF participation and to keep the Eurozone intact. Meanwhile Merkel’s spokesman Seibert said Greek reform needs must be clarified with the institutions.

WTI is off by 0.5% presently, at $53.60, correcting after rallying from last Wednesday’s three-week low at $51.22 through to Friday’s peak at $54.13, which is the loftiest level posted since February 2. Prices are continuing to track in the broadly sideways trend that’s been in place since early January. Kuwait’s oil minister said oil prices should continue to rise, noting that there has been a 92% rate of compliance among OPEC members of the supply cut accord, and while the figure is only 50% for non-OPEC collaborators, this would improve over time as pre-existing commitments are completed.

U.S. Fed Chair Yellen should headline this week when she goes to Capitol Hill to give her twice-yearly Humphrey-Hawkins testimony to Congress. She is expected to testify in front of the senate on Tuesday and the house on Wednesday. If there are any plans for the Fed to increase interest rates in March, Yellen will need to tip her hand this week. The key for the markets will be her outlook on the normalization path, including the balance sheet.

About the Author

David Beckerauthor

David Becker focuses his attention on various consulting and portfolio management activities at Fortuity LLC, where he currently provides oversight for a multimillion-dollar portfolio consisting of commodities, debt, equities, real estate, and more.

Advertisement