Advertisement

Advertisement

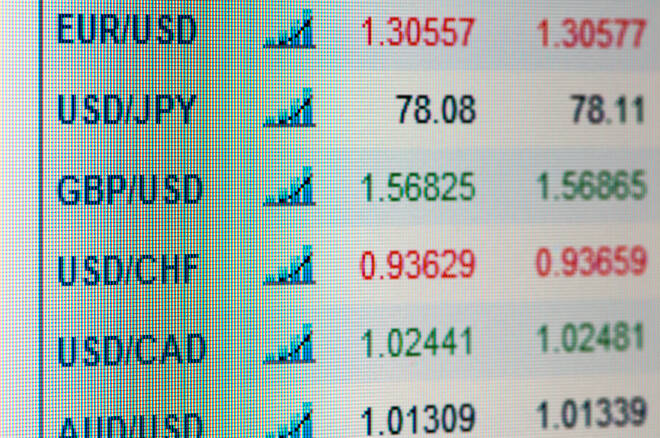

Risk Aversion Drives Dollar Demand as Market Sentiment towards the Economic Outlook Dims

By:

With the EU on holiday, U.S stats and sentiment towards the economic outlook will remain in focus on the day.

Earlier in the Day:

It was a relatively busy start to the day on the economic calendar this morning. The Japanese Yen and the Aussie Dollar were in action in the early part of the day.

Outside of the numbers, yet more dire economic data from the U.S tested risk sentiment in the early part of the day.

The weak numbers overshadowed the positive sentiment towards COVID-19 treatment drug remdesivir that had fueled Wednesday’s rally in the U.S.

New coronavirus cases continued to rise throughout the week. The markets were focused elsewhere, however, with government plans to ease lockdown measures unwavering.

On Thursday, the number of new coronavirus cases rose by 89,675 to 3,301,792. On Wednesday, the number of new cases had risen by 77,918. The number of new cases was also higher than the previous Thursday’s 80,696 increase.

France, Germany, Italy, and Spain reported 7,182 new cases on Thursday. On Wednesday, the number of new cases had risen by 8,651. France reported just 758 new cases, with Spain and Italy also seeing a downtrend from Wednesday.

From the U.S, the total number of cases rose by 30,883 to 1,094,400 on Thursday. This was up from 27,752 new cases on Wednesday. On the previous Thursday, the total number of new cases had risen by 30,926.

For the Japanese Yen

Inflation figures were in focus this morning.

The Ku-area of Tokyo saw deflationary pressures return, with core consumer prices fall by 0.1% year-on-year. Economists had forecast a core annual rate of inflation of 0.1%, following 0.4% in March. The annual rate of inflation eased from 0.4% to 0.2% in April.

According to the Ministry of Internal Affairs and Communication.

- Prices for education (-8.1%) and fuel, light, and water charges (-2.5%) pinned back inflation in April.

- There was also a 0.2% decline in prices for transportation and communication.

- Prices for clothes & footwear (+1.7%), medical care (+0.9%), furniture & household utensils (+0.8%), and culture & recreation (+0.1%) limited the damage.

- Month-on-month, core consumer prices slid by 0.3%.

The Japanese Yen moved from ¥107.190 to ¥107.266 upon release of the figures. At the time of writing, the Japanese Yen was up by 0.06% to ¥107.12 against the U.S Dollar.

Of less influence, but worth noting, was a downward revision to Japan’s April Manufacturing PMI from 43.7 to 41.9. In March, the PMI had stood at 44.8. Production fell at the sharpest pace since 2009

For the Aussie Dollar

It was a busy morning. Manufacturing and wholesale inflation figures were in focus this morning.

In April, the AIG Manufacturing Index slid from 53.7 to 35.8. In March, the Index had risen from 44.3 to 53.7.

According to the April report, the manufacturing sector contracted at its worst pace since April 2009.

- The monthly fall of 17.9 points was also the largest on record.

- The March pickup in demand for manufactured foods and groceries came to an end in April, weighed by an end to the hoarding seen in March.

- As a result of COVID-19 and lockdown measures, no new sales, cancellation of orders, supply chain disruption, increased raw material prices all weighed.

- In April, all activity indices slumped by levels akin to those last seen during the Global Financial Crisis.

The Aussie Dollar moved from $0.64841 to $0.64917 upon release of the figures.

Wholesale inflationary pressures eased in the 1st quarter, with the annual rate of wholesale inflation softening from 1.4% to 1.3%. Quarter-on-quarter, the Producer Price Index rose by 0.2%, following a 0.3% increase in the 4th quarter.

According to the ABS,

- There were rises in other agri (+11.2%), tertiary education (+1.6%), and electricity supply; gas supply; and water supply, sewerage, and draining services (+1.1%).

- Dragging in the 1st quarter, however, were declines in petroleum refining and petroleum fuel manufacturing (-14.1%) and accommodation (-5.6%).

The Aussie Dollar moved from $0.64726 to $0.64743 upon release of the figures. At the time of writing, the Aussie Dollar was down by 0.58% to $0.6474.

Elsewhere

The Kiwi Dollar was down by 0.49% to $0.6097, with the risk-off sentiment weighing early on.

The Day Ahead:

For the EUR

It’s a particularly quiet day ahead on the economic calendar, with the European markets closed today.

Dire economic data from the U.S saw the EUR return to $1.09 levels on Thursday. With EU member states easing lockdown measures, much will now depend on the COVID-19 numbers. A jump in new cases would send the EUR back to $1.07 levels.

For the day ahead, expect market risk sentiment to be the key driver.

At the time of writing, the EUR was down by 0.15% to $1.0939.

For the Pound

It’s a relatively busy day ahead on the economic calendar. Key stats include finalized April Manufacturing PMI numbers.

While any downward revision would be Pound negative, the focus will be on the UK’s economic outlook.

Thursday’s government update was Pound positive, with the government planning to ease lockdown measures from next week. Johnson also stated that the UK was past the peak, which will leave the Pound sensitive to any jumps in new cases…

Away from the numbers, expect risk sentiment to be the key driver on the day.

At the time of writing, the Pound was down by 0.31% to $1.2555, with concerns over the global economic outlook weighing early on.

Across the Pond

It’s a relatively busy day ahead on the U.S economic calendar. Key stats include April’s finalized Markit Manufacturing PMI and the market’s preferred ISM Manufacturing PMI.

Forecasts are for a greater contraction in the sector, which would add to the doom and gloom following Thursday’s stats.

Expect dire numbers to drive demand for the safe havens, which includes the Greenback…

The Dollar Spot Index was up by 0.15% to 99.164 at the time of writing.

For the Loonie

It’s a quiet day on the economic calendar, with no material stats to provide direction on the day.

The lack of stats will leave the Loonie in the hands of market risk sentiment on the day.

At the time of writing, the Loonie was down by 0.26% to C$1.3981 against the U.S Dollar, at the time of writing.

About the Author

Bob Masonauthor

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Advertisement