Advertisement

Advertisement

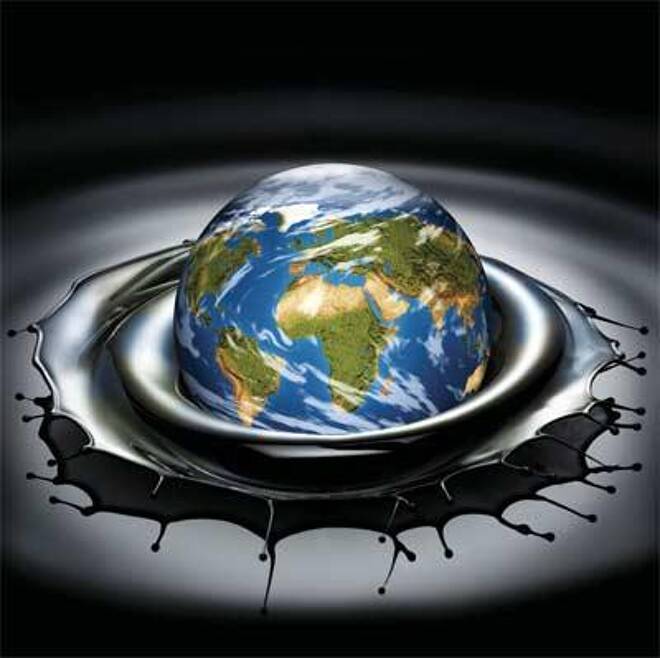

There Is No More Space To Store Excess Oil

By:

Crude oil is trading near its lowest price in 2015 falling to 41.53 giving up another 22 cents in the morning session after falling 4% in a single session

Crude prices dropped to the lowest level after U.S. oil stockpiles climbed for a seventh week. The official U.S. data showed that crude inventories rose by 4.2 million barrels last week against a market expectation of a 1.3 million barrel gain.

Oil markets have been dogged by oversupply, which analysts estimate to be between 0.7 and 2.5 million barrels of oil being produced every day without a buyer, and which has resulted in prices falling by almost two-thirds since June 2014.

U.S. gasoline was also battered, tumbling 4 percent, despite a weekly draw in the motor fuel’s stockpiles. Heating oil futures

The storage spike has sharply widened prompt crude’s discount to oil slated for later delivery as traders hold more in hopes of selling at higher prices later. On Thursday, prompt U.S. crude’s discount to the second-month was at its largest since the end of April.

Oil traders are also watching global tanker traffic carefully this month amid signs that unsold crude may be accumulating on the water. Reuters shipping data showed tankers with nearly 20 million barrels of Iraqi oil due to sail to the United States in November, potentially the largest import wave in years, while dozens of tankers are already queuing off the Texas coast.

Rising levels of crude stored at sea has more to do with shrinking capacity onshore, rather than traders stockpiling volumes in order to profit from an eventual rebound in prices. Oil tanker rates have surged this year, so it doesn’t exactly make sense to store oil at sea strictly for a trading opportunity. Daily rates for very large crude carriers are around $60,000 per day, although down from a peak of $111,000 per day hit on October 8. The collapse of crude prices over the past year has contributed to a surge in tanker rates.

The contango situation in oil markets – in which front month contracts are cheaper than delivery at some point in the future – is growing, but not quite large enough to justify storing oil at sea. The premium for delivery at six months in the future compared to today is $4.50 per barrel.

The brimming levels of storage at sea mirror the rising onshore figures for crude oil storage around the world. In the U.S., crude storage levels hit 487 million barrels in early November, closing in on the 80-year high of 490 million barrels hit earlier this year. And OPEC reported that crude oil stockpiles in OECD countries currently exceed the running five-year average by 210 million barrels. Storage is now at the highest level in at least a decade.

About the Author

Barry Normanauthor

Advertisement