Advertisement

Advertisement

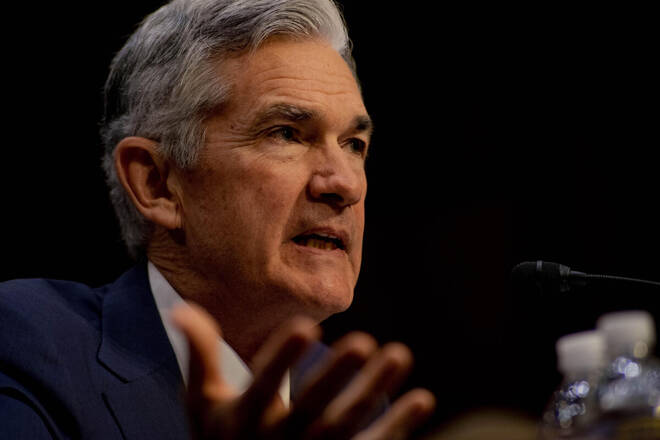

Traders Bet Against Fed Rate Hikes After Powell’s Comments

By:

Traders also react to the reports indicating that debt-ceiling talks were paused.

Key Insights

- Powell confirmed that Fed remained strongly committed to its inflation target.

- He noted that the situation in the banking system remained stable so Fed would not have to raise rates as high as previously expected.

- Gold moved away from multi-week lows as traders bet on a less hawkish Fed.

Powell’s Comments Are More Dovish Than Expected

On May 19, Fed Chair Jerome Powell delivered comments at Thomas Laubach Research Conference. Powell has once again stated that Fed remained strongly committed to pushing inflation back to the 2% target.

Powell has also noted that price stability was the foundation of the economy. He added that failure to get inflation down would prolong the pain felt by the people who are struggling with high prices.

Talking about banks, Powell said that the situation was under control and that Fed would not have to raise rates as much as previously expected.

Powell also noted that the situation in the labor market was playing an important role in the current inflation.

According to FedWatch Tool, the probability of a rate hike at the next Fed meeting in June declined after Powell’s comments. Currently, there is a 28.9% probability of a 25 bps rate hike. Traders expect that Fed will cut the federal funds rate from 500 – 525 bps to 450 – 475 bps by the end of the year.

Gold Rebounds From Multi-Week Lows

Gold rebounded towards the $1975 level as traders reacted to the comments from Fed Chair. Powell’s comments on the banking system served as the key catalyst for the move as the probability of a rate hike decreased.

U.S. Dollar Index declined towards the 103 level as Treasury yields pulled back from session highs. Traders bet on a less hawkish Fed.

SP500 pulled back below the 4200 level. Traders react to the recent reports indicating that debt ceiling negotiations were paused.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Vladimir Zernovauthor

Vladimir is an independent trader, with over 18 years of experience in the financial markets. His expertise spans a wide range of instruments like stocks, futures, forex, indices, and commodities, forecasting both long-term and short-term market movements.

Advertisement